ARTICLE AD BOX

By Nikhil Inamdar and Ayushi Shah

BBC News

Rachana Ranade has 3.5 million subscribers on YouTube

A growing appetite for easy-to-understand financial content among India's tech-savvy, young investors has made it one of the fastest growing genres in digital space.

When the pandemic hit two years ago and movie studios in Mumbai downed their shutters indefinitely, 23-year-old filmmaker Shivam Khatri decided to teach himself a skill he'd not learnt in school or college - managing money.

He rummaged through books and tutorials, but quickly learnt that it was the young financial content creators on YouTube that spoke his language.

"Their videos are simple and easy to understand. And they cover a variety of topics," Mr Khatri says.

One of the creators he followed avidly was Rachana Ranade, whose impish, easy, breezy manner of breaking down complex financial jargon into easily digestible content has earned her 3.5 million subscribers on YouTube.

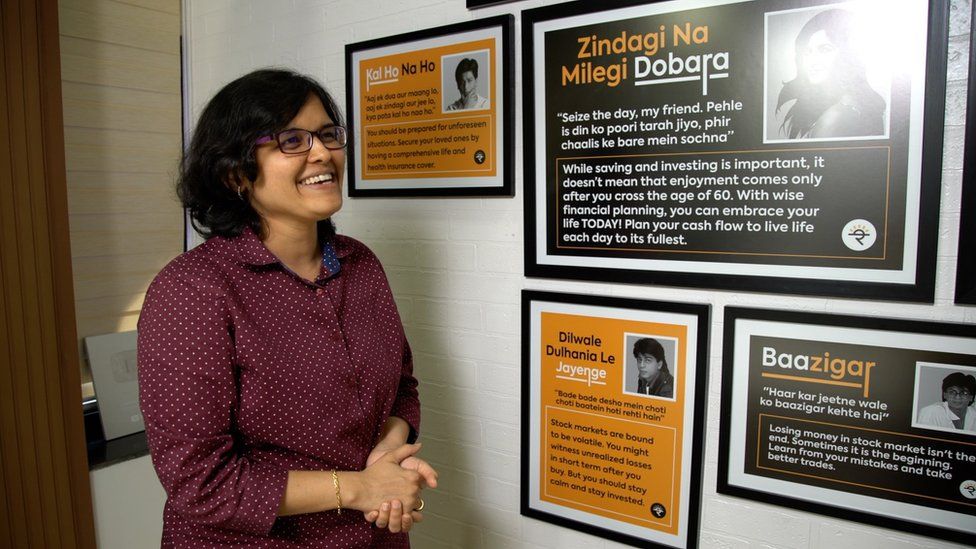

In her swanky new office in the western city of Pune, Ms Ranade showed us a wall-to-wall graphic that mapped her rise as a YouTuber.

She uploaded her first video in February 2019 and in barely five months she'd reached a 100,000 subscribers. Her growth since then has been nothing short of meteoric.

Ms Ranade often gets mobbed for autographs and selfies - the kind of adulation normally reserved for Bollywood celebrities or cricketing icons.

An unabashed movie buff, one wall of her office cabin features quotes from Shah Rukh Khan movies. She uses these quotes to explain financial concepts that are hard to grasp. There's one from the hit film Kal Ho Na Ho to drive a point on the need to buy life insurance.

It all boils down to one mantra - "finance that's simplified", Ms Ranade says.

Image source, Getty Images

Image caption,Millions of young Indians opened trading accounts during the pandemic

It's exactly what India's tech-savvy, young investors are after. Millions of them opened trading accounts during the pandemic to participate in the market bull run, aided by investing services offered by online brokerages at the click of a button.

But only three out of 10 Indians are financially literate, official surveys point out. And they are hungry to learn how to make an easy buck in the stock market, or to learn the ropes of entrepreneurship amid a unicorn boom that's made overnight billionaires.

It's this sweet spot that's pushed financial content among the fastest growing genres in the digital space.

"For the Gen-Z and millennials, YouTube is a university now in India," says Ankur Warikoo, an entrepreneur-turned-'fin-fluencer' - or financial influencer - whose videos focus on personal finance, entrepreneurship and productivity hacks.

His massive popularity even got him a publishing contract last year, with his first book, Do Epic Shit, becoming a quick bestseller.

Ankur Warikoo's videos have made him popular with young Indians

While the perception is that he became an overnight online sensation, Mr Warikoo says his content creation journey started nearly a decade ago. But the pandemic proved to be a real inflection point for him and the entire ecosystem of finance content creators.

"Suddenly, there was a rise in high-quality content being offered by a lot of creators. There was an audience with time and money at hand, and a market that was extremely supportive," says Mr Warikoo. "If this was a bear run, you would struggle to put your point across."

It was "a potent mix" of enabling factors - such as cheap data, growing internet penetration and the shift among India's Gen-Z and millennial population from TV and print to digital video - that led to this success, Mr Warikoo says. "Especially with a topic like money, which is something that we all wish to understand but have very rarely been given an opportunity to," he says.

It isn't an assertion that's entirely off the mark.

For years, India has had more business channels broadcasting real-time financial market content than there's been appetite for. But they've all broadly catered to a small coterie of traders and institutional investors, rather than small, first-time market entrants looking to understand the basics.

But many of the YouTubers have successfully been able to fill this market gap. And they are being wooed with big money from advertisers and brand managers through collaborations and placements.

Rachana Ranade uses film dialogue to explain financial concepts that are hard to grasp

According to Forbes, top influencers can earn as much as $20,000 for a single branded video.

From a consumer's perspective, though, while experts laud this trend for democratising financial education, they advise caution.

While business TV anchors are strictly regulated, most digital content creators operate in a regulatory grey zone. While Ms Ranade and Mr Warikoo do not give direct stock tips or recommendations, many others do, often without certification or the necessary expertise.

"When it comes to slightly finer issues of long-term investing, I would trust people who have been through a few market cycles. Right now while this digital phenomenon has overtaken us, everything has only gone up," says Govindraj Ethiraj, a former editor at a business channel, who now runs a fact-checking website.

After a two-year bull run, Indian equity markets are seeing extreme volatility with billions of dollars of foreign money being pulled out of the country. It will be the first real test of how enduring or ephemeral the success of India's money influencers is, Mr Ethiraj says.

2 years ago

28

2 years ago

28

English (US)

English (US)