ARTICLE AD BOX

By Sam Cabral

BBC News, Washington

Image source, Getty Images

Image source, Getty Images

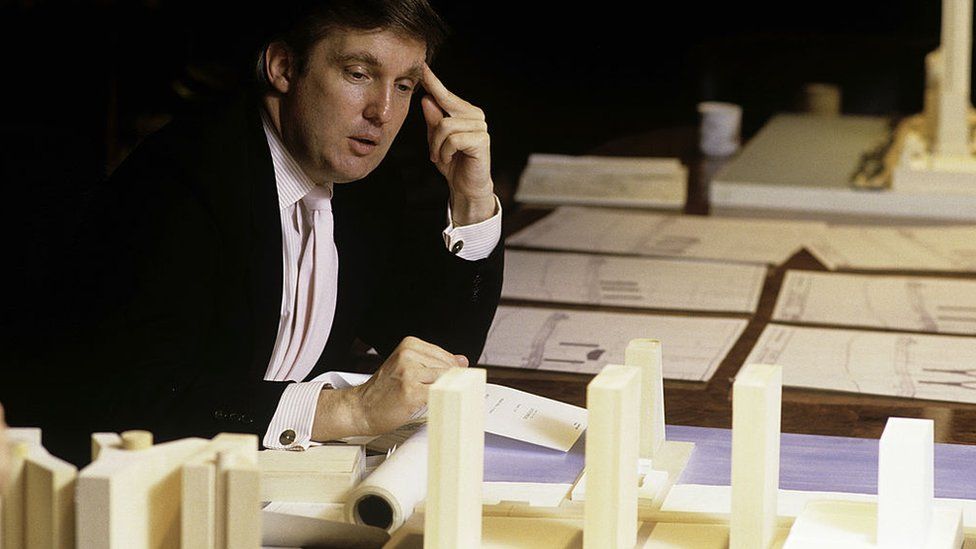

Donald Trump has built his real estate empire since the 1970s

"The Art of the Deal" made Donald Trump a household name in real estate. But New York's top prosecutor is accusing the former US president of "the art of the steal" - alleging he grossly misrepresented the value of multiple properties he owns.

Attorney General Letitia James sued Mr Trump and three of his adult children on Wednesday, on claims they engaged in years of financial fraud to secure favourable loans, tax benefits and other economic advantages.

Mr Trump has denied any wrongdoing, slamming the civil suit brought by the Democrat as "another witch hunt".

The lawsuit alleges misconduct across nearly two dozen Trump-owned properties in the US and overseas, many of them well-known.

They include New York City's Trump Tower, where the family business is headquartered, and the sprawling Mar-a-Lago estate in Florida that the ex-president now calls home.

Here is a closer look at some of the claims made by Ms James' office:

Trump International Golf Links

Image source, Getty Images

Image caption,The course is built on 4,000-year-old sand dunes at Balmedie, in Scotland

Mr Trump's golf resort on the Menie estate in Aberdeenshire, in north-east Scotland, has long been the subject of controversy.

Two years ago, officials stripped the site of its special status as a nationally-important protected environment after a local government watchdog said the 18-hole course had "partially destroyed" the 4,000-year-old sand dunes it was built on. Trump International described the move as "highly politicised".

According to Ms James' legal complaint, the property's value is "grossly inflated".

She said its 2014 valuation - at $327m - relied in large part on an assumption that 2,500 homes could be developed on the 1,400-acre land.

But investigators are said to have learned the Trump Organization had received zoning approval six years earlier for fewer than 1,500 homes, most of which were only intended to be short-term holiday rentals.

The misleading figure "more than tripled the value of the undeveloped land" at Trump International Golf Links, the suit claims.

Additionally, the court document asserts that an earlier valuation of the undeveloped land in 2011 had relied solely on a Trump Organization executive's email to Forbes Magazine, rather than a professional appraisal.

The triplex at Trump Tower

Image source, Getty Images

Image caption,The skyscraper rises over Fifth Avenue in the Manhattan neighbourhood of New York City

One of Manhattan's most recognised skyscrapers, the Trump Tower in New York City was Mr Trump's primary residence until 2020.

He still maintains a penthouse condominium that spans the top three floors of the 58-storey building, and he has often boasted about the size of his gilded palace.

The problem? It is allegedly not as big as he says it is.

It is claimed that, while Mr Trump has repeatedly valued the triplex as being more than 30,000 square feet, property records - several of which contain his signature - affirm it is in fact less than 11,000 square feet.

"Tripling the size of the apartment for purposes of the valuation was intentional and deliberate fraud, not an honest mistake," plaintiffs in the New York lawsuit write.

Deliberately misrepresenting its size, and multiplying it by what the suit claims was "an unreasonable price per square foot", saw the apartment valued at $327m in 2015.

"That price was absurd, given the fact that at that point only one apartment in New York City had ever sold for even $100 million... and that sale was in a newly built, ultra-tall tower," the plaintiffs continue.

"In 30-year-old Trump Tower, the record sale at that time was a mere $16.5 million."

The Mar-a-Lago Club

Image source, Getty Images

Image caption,The beachfront resort is a national historic landmark in Palm Beach, Florida

The 17-acre Mar-a-Lago estate on the Florida coastline was purchased by Mr Trump in 1985.

Formally designated by then as a National Historic Landmark, it initially functioned as a private residence before Mr Trump converted it to a members-only social club in 1994.

Wednesday's court filing - which names the estate more than 50 times - states that Mr Trump made the change because he worried the property was a "white elephant" that was too expensive to use, preserve or sell for residential use.

Yet his valuations treated the land as "an unrestricted home to 'be sold to an individual', rather than the heavily encumbered historical landmark restricted to club usage that it was", the suit claims.

This was allegedly in spite of Mr Trump signing deeds that gave up residential development rights and restricted changes to the property.

The lawsuit claims that Ms James' office found that this false premise backed up valuations year after year from 2011 through 2021, with the property's value peaking at $739m.

"In reality, the club generated annual revenues of less than $25 million and should have been valued at closer to $75 million," the plaintiffs claim.

Trump International Hotel and Tower Chicago

Image source, Getty Images

Image caption,The building sits on the Chicago River

At nearly 100 storeys tall, the Trump International Hotel and Tower in downtown Chicago is the city's second-tallest building, standing out even among the huge skyscrapers that line the Chicago River.

But according to the lawsuit in New York, Mr Trump declared the luxury building - built at a cost of $850m and stuffed with apartments, hotel rooms and restaurants - "worthless".

The lawsuit alleges the claim would help offset taxes because it qualified as a substantial loss under the federal tax code. At the same time, however, the former president was allegedly obtaining loans against the tower from Deutsche Bank.

The German financial institution loaned billions to Mr Trump for decades despite his defaults and lawsuits against the bank, although it vowed to stop lending to the ex-president shortly after last year's riots at the US Capitol.

Government lawyers say Mr Trump has excluded Trump Chicago on financial statements since 2009, but has obtained more than $100m in loans on the buildings since 2011.

On the initial $107m loan in 2012, Mr Trump's supposed net worth of $4bn was allegedly used as a personal guaranty, securing a favourably low interest rate.

The lawsuit goes on to claim that Mr Trump and the Trump Organization obtained favourable terms from Deutsche Bank on at least two other properties, including the now-sold Trump Hotel in Washington DC.

2 years ago

44

2 years ago

44

English (US)

English (US)