ARTICLE AD BOX

Wrongful deductions from an energy company left Helen Timson struggling to pay her rent

The government is still deducting money from people's Universal Credit to pay their utility bills, despite it losing a legal case concerning other benefits.

Last year, High Court judges said a scheme - which allows money to be taken from people claiming benefits to pay energy bills - was unlawful if the claimant had not first consented.

But the ruling did not cover people on Universal Credit and BBC News has found thousands are still having money taken.

The government says the policy is fair.

It said the scheme protected people from the potential "serious consequences" if bills were not paid - including homelessness, disconnection, court action and ultimately imprisonment. But critics say it is unfair.

'Unlawful'

Under the policy, private utility companies and others can apply to the Department for Work and Pensions (DWP) for up to 25% of a person's benefits to be paid directly to them - to repay a debt and meet ongoing usage costs.

However, in September last year, a disabled former Leicestershire police constable won a High Court case against the scheme.

Helen Timson's legal challenge concluded more than four years after she noticed wrongful deductions

Helen Timson, who was unable to work because of physical and mental health conditions, said deductions had left her unable to pay her rent and at one point she had to cancel an appointment for an NHS cancer scan because she could not afford to pay for a taxi.

She successfully argued it was unlawful to take money without first checking with the claimant that they could afford to repay the amount, or challenge if they owed money at all.

However, while the ruling applied to some people on so-called legacy benefits - such as jobseeker's allowance (JSA) and income-related employment and support allowance (ESA) - it did not apply to Universal Credit.

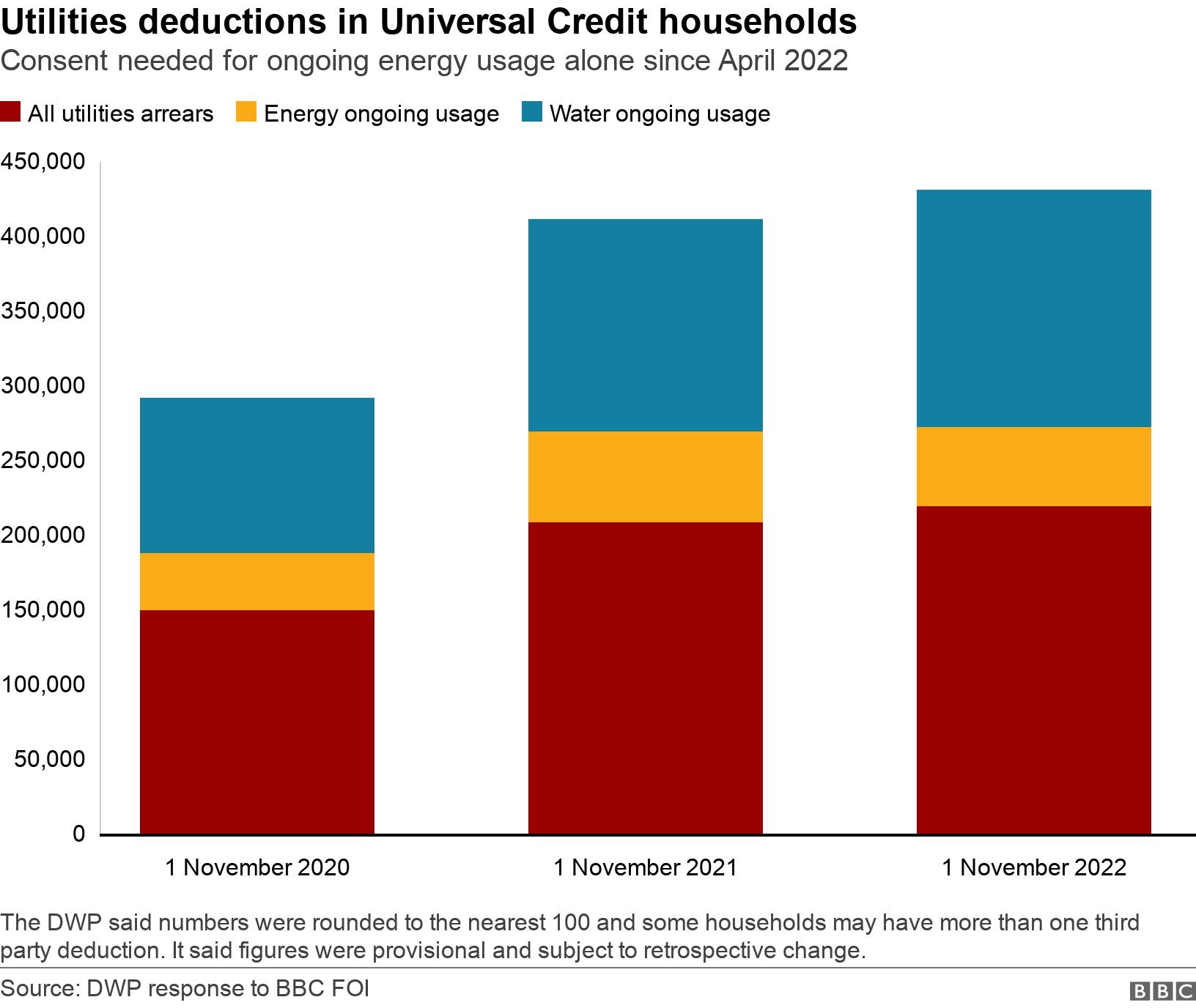

Following a separate legal change, which took effect in April 2022, households receiving Universal Credit must now be asked to agree to new deductions for ongoing usage costs for electricity or gas. However, the DWP is still not legally required to ask for consent for new deductions for electricity or gas bill that are in arrears, or any water bills.

Latest figures for November 2022 showed around 431,800 automatic deductions were in place from households receiving Universal Credit for utilities bills. A Freedom of Information request by BBC News has found 221,000 of those were for arrears.

Ms Timson said she had faced deductions several times without her consent, including when an energy company wrongly deducted £80.80 a month for a year-and-a-half for a non-existent debt up until 2019. She had already settled and closed her account with the company.

She told the BBC the scheme was "fundamentally wrong". She said: "Can you imagine the uproar if banks handed over customers' savings at the request of utility companies or employers handed over wages," Ms Timson asked.

"The DWP have wasted more taxpayer money defending the indefensible again at court, in the hope the DWP can remain taxpayer-funded debt collectors for utility companies."

In June, the DWP lost an appeal against the High Court ruling and is now allowing people the chance to submit representations before new deductions are made from legacy benefits.

However, it says it does not plan to retrospectively seek consent from anyone already having money deducted.

The DWP also confirmed it did not make any money from administering third party deductions and the final costs of contesting the judicial review and appeal with Ms Timson were not yet known.

Andrew Sykes said he helped people pause deductions for 12 months by applying for a debt relief order

Counselling and money advice service, Noah's Ark Centre, in Halifax, says it has helped more than 1,500 people across Calderdale since 2017 who had money taken from their benefits.

Of those, 84% were for utilities bills.

Andrew Sykes, a volunteer at the service, says he saw an "explosion" in deductions when Universal Credit was introduced fully in the area.

"Every client that comes through our doors is suffering anxiety in one form or another," Mr Sykes said.

"We get lots of referrals where people are threatening suicide. Money and debt problems are destructive and really shouldn't be underestimated."

Chelsea Elliman said she 'hid behind her blinds' when people knocked the door when she was in debt

Mother-of-three Chelsea Elliman says she faced deductions of £114.10 a month from her Universal Credit payments - most of which was to pay arrears to a water company and for her ongoing usage.

"I'd not given any consent, I'd not spoken to anyone and when I realised it was coming out, no one had sat me down and said 'can she afford to pay this?'," Miss Elliman, 27, said.

"I was resorting to a food bank. I wasn't eating. I was eating bits and scraps from the table the children didn't eat."

Jonathan Bean, from Fuel Poverty Action, said unexpected deductions from people on the breadline risked sending them into "a cash flow crisis". He said it would not help people cope with multiple unpayable bills.

Duncan Shrubsole, from Lloyds Bank Foundation, which supports around 600 charities, said: "The policy is harmful. Alongside other charities we have called for government to reduce the overall maximum deduction rate to 15%."

The DWP said safeguards were in place to allow claimants to dispute deductions and ensure payments were "manageable" including the ability to submit an appeal, called a mandatory reconsideration.

It said people claiming Universal Credit were notified in advance, via their online account, and letters were sent to people receiving legacy benefits before third party deductions were applied, stating how to challenge them.

A spokesperson said the DWP had reduced its standard cap on deductions in Universal Credit "twice in recent years" to 25%.

What to do if I cannot pay my debts

- Take control. Citizens Advice suggest you work out how much you owe, to whom, which debts are the most urgent and how much you need to pay each month.

- Check you are getting the right money. Use the independent MoneyHelper website or benefits calculators run by Policy in Practice and charities Entitledto and Turn2us.

Tackling It Together: More tips to help you.

Related Internet Links

The BBC is not responsible for the content of external sites.

1 year ago

56

1 year ago

56

English (US) ·

English (US) ·