ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

Chancellor Jeremy Hunt will announce at the Autumn Statement how much benefits will rise next year.

The changes will take place from April 2024.

How much could benefits increase?

Most working-age benefits increase every April, in line with the previous September's CPI inflation rate. This was 6.7% in September 2023.

Inflation measures how fast prices are rising based on the cost of a basket of goods.

But there have been rumours that the government could decide to use the October figure instead, which was 4.6%.

This would save the government about £3bn next year, according to the independent Institute for Fiscal Studies think tank.

State pensions go up in line with the so-called triple lock, which means they rise by inflation, average earnings or 2.5%, whichever is higher.

This year, the highest would be the rise in average wages, which would be 8.5%.

But it has been reported that the government is considering using a lower measure of average earnings excluding bonuses, which would mean the state pension would go up by only 7.8%.

Benefits are fully devolved in Northern Ireland, but changes are likely to be similar to those for the rest of the UK.

In Scotland some disability benefits are devolved, meaning the Scottish government decides how to increase them.

How much is spent on benefits?

In August 2023, 22.6 million people were claiming some form of benefits, in England, Scotland and Wales.

In 2023-24, the government is expected to spend £265.5bn on paying pensions and benefits, just over half of which (£134.8bn) goes on benefits to pensioners.

By comparison, the government is expected to spend £245bn on health.

Universal credit

After the state pension, universal credit (UC) is the government's highest benefit spend, allocated £59.8bn this year.

In October 2023, 6.2 million people were claiming it, about 38% of whom have jobs.

UC is a monthly payment to help with living costs. It was introduced to replace a number of existing benefits, including:

- child tax credit

- housing benefit

- income support

- income-based jobseeker's allowance

Housing benefit

It is expected that £14.3bn will be spent on housing benefit this year, which helps people pay their rent.

In May 2023, there were 1.3 million working-age recipients and 1.1 million of pension age.

Housing benefit is gradually being replaced by UC.

Disability benefits

The main benefits for disabled people are:

In February 2023 there were:

- 1.6 million people claiming ESA

- 4.2 million people claiming either PIP or DLA

- 1.6 million attendance allowance claimants

Child benefit

The government is expected to spend £12.6bn on child benefit this year.

Since 2013, claimants earning more than £50,000 gradually have the benefit reduced the more they earn.

At £60,000 and above, child benefit is fully withdrawn.

And that figure has not been adjusted to reflect rising prices since then, meaning it now affects many more people.

In August 2022, seven million families were receiving child benefit.

Personal tax credits

The government is expected to spend £8.8bn on them this year.

Pension Credit

Separate from the state pension, pension credit helps people over state-pension age with low incomes with living costs, at a cost of £5bn in 2023-24.

More than 1.4 million people currently receive pension credit, although the government says there are significantly more eligible pensioners who do not claim.

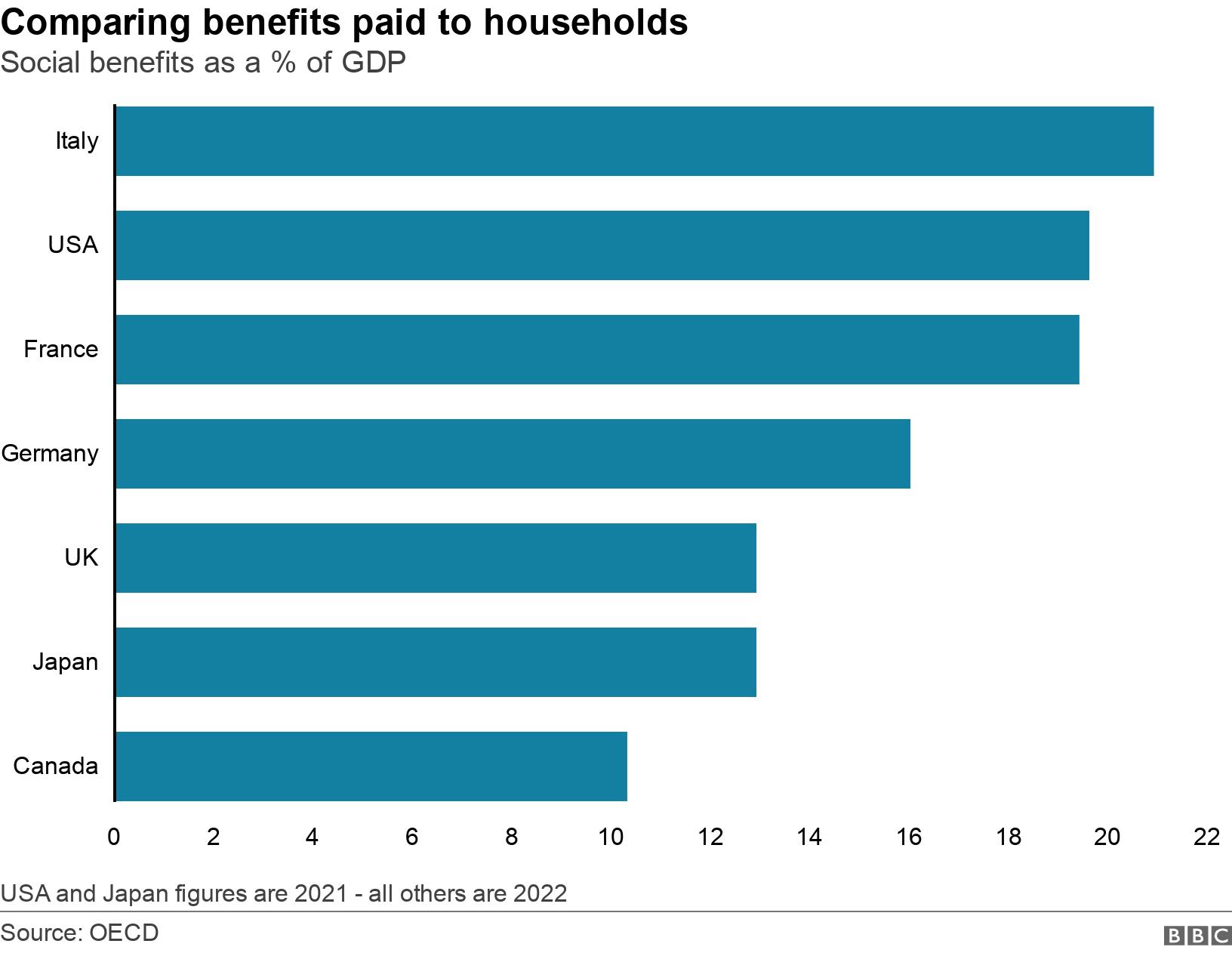

How does UK benefit spending compare with other countries?

The UK spends 12.9% of gross domestic product (GDP) - the total value of goods and services produced in the country - on social benefits, according to the latest data from the Organisation for Economic Co-operation and Development (OECD).

That puts it in fifth place on the G7 list of big economies.

1 year ago

39

1 year ago

39

English (US) ·

English (US) ·