ARTICLE AD BOX

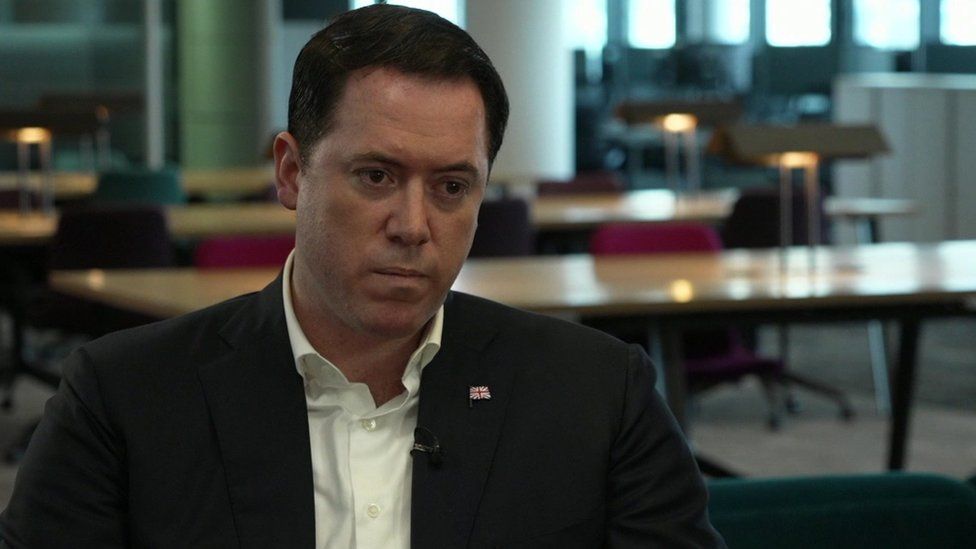

David Collard was arrested after an alleged altercation in New York

The man behind a buyout of the collapsed battery maker Britishvolt has been charged with assault and harassment in New York.

The charges against David Collard followed an alleged altercation on Madison Avenue in November.

The incident, first reported by Australian website Open Politics, occurred at a time when the future of the takeover remains uncertain.

Mr Collard insists he acted in self-defence.

The incident in New York occurred on Wednesday, 15 November. According to court documents, Mr Collard was accused of striking a man about the face with a closed fist causing "a laceration to the right side of the face and substantial pain".

In total he faces two charges of assault causing physical injury and one of attempted assault, as well as further charges of harassment and aggravated harassment. He has pleaded not guilty.

In a statement, provided to Open Politics, Mr Collard said he had intervened to protect a female friend who had been experiencing harassment.

"Confronting the individual, an altercation ensued due to his aggressive behaviour. In self-defence, I took appropriate measures," he said.

Britishvolt

Mr Collard is the founder of Scale Facilitation, an investment firm based in his native Australia. Its subsidiary Recharge Industries agreed to take control of Britishvolt after it went into administration in January.

The ambitious British start-up had planned to build a £4bn "gigafactory" to manufacture battery packs for a new generation of electric cars. It was once hailed by the former Prime Minister, Boris Johnson, as a part of his "green industrial revolution".

It would have been built on the site of an old power station at Cambois, near Blyth in Northumberland. But the venture ran out of money and collapsed into administration in early 2023.

Mr Collard agreed to buy the company for £8.57m, saying he would use the site to build batteries for the Australian military.

However, the final instalment of £2.47m, due in April last year, remains outstanding. Earlier this month, the administrator EY extended the administration period until January 2025.

In order to secure the Cambois site, Recharge Industries would also need to raise another £11m to pay property investor Katch, which has a financial claim on it.

Current and former staff at Britishvolt have repeatedly complained that money due to them, including several months of wages and pension contributions, have been left unpaid.

One former senior executive was paid in full in December, but only after issuing a statutory demand - the final step a creditor needs to take before issuing a formal request to wind up a company.

The BBC understands at least seven further statutory demands have since been issued, and Mr Collard has agreed payment plans with some of those involved. But others say they have heard nothing.

For several months, Mr Collard has insisted that funding from a new investor is imminent, and that this would allow the deal to go forward. However, it has yet to materialise.

Sources within Recharge Industries have previously acknowledged that a tax raid by Australian federal police on its parent company Scale Facilitation in June last year made finding new funding more difficult.

At the time, sources close to Mr Collard said the raid was due to a misunderstanding of the interaction between US and Australian tax filings, and that all parties were co-operating.

Scale Facilitation denied any wrongdoing. However, the incident served to fuel growing doubts about the Britishvolt project.

EY, which worked as an adviser to Britishvolt prior to its collapse before taking on the role of administrator afterwards, has defended its decision to sell the business to Recharge Industries.

It has pointed out that "£6.1m was received on initial completion of the transaction. This payment, which has been received, was materially above the next best alternative, deliverable offer received by the joint administrators."

1 year ago

54

1 year ago

54

English (US) ·

English (US) ·