ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

By Daniel Thomas

Business reporter, BBC News

The government will reveal long awaited plans to regulate "buy now pay later" firms on Tuesday, as it vows to stop "unconstrained borrowing".

The Treasury said the new rules would protect up to 10 million people from being "exposed to financial harm".

Lenders will have to do better affordability checks on borrowers and offer clearer information on loans.

Customers will also be able to take complaints about companies to the Financial Ombudsman.

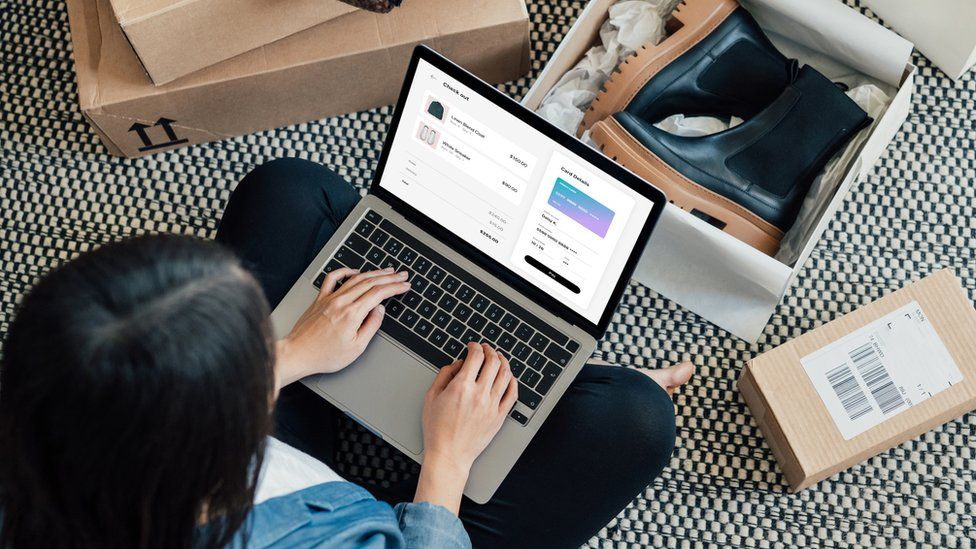

Buy now pay later products allow consumers to pay for goods in instalments, typically interest free.

But while they have surged in popularity, particularly among young people, they remain largely unregulated, raising concerns about people falling into debt.

Users are also not entitled to any breathing space when they cannot afford to repay, or compensation if things go wrong.

'Painfully slow'

The government first promised to regulate the sector in 2021, and has been "painfully slow" in bringing legislation forward, according to consumer champion Martin Lewis.

Last February, the Financial Conduct Authority (FCA) told the four biggest buy now pay later operators - Clearpay, Klarna, Laybuy and Openpay - to change their contracts after identifying potential harm to customers.

But it had to use consumer rights law in the absence of specific legislation.

Under the new plans, the FCA would be given powers to clamp down on firms who break the rules, including banning them from further lending. Firms would also have to be licensed by the FCA and would face tougher rules when advertising their products.

The plans will be published by the Treasury in a consultation paper on Tuesday and are expected to become law before the end of 2023.

"People should be able to access affordable credit, but with clear protections in place," said Financial Services Minister Andrew Griffith.

Britain's buy now pay later sector nearly quadrupled in size during the pandemic in 2020 to £2.7bn.

Recent research from the Centre For Financial Capability, a financial education charity, said people of all ages were now turning to the sector as they struggled with the cost of living, showing the need for urgent regulation.

A recent survey by Citizens Advice heard from 2,288 people who had used buy now pay later during the previous 12 months.

It found that 52% made repayments from their current account, but 23% used a credit card, 9% used a bank overdraft and 7% borrowed from friends and family.

2 years ago

47

2 years ago

47

English (US) ·

English (US) ·