ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

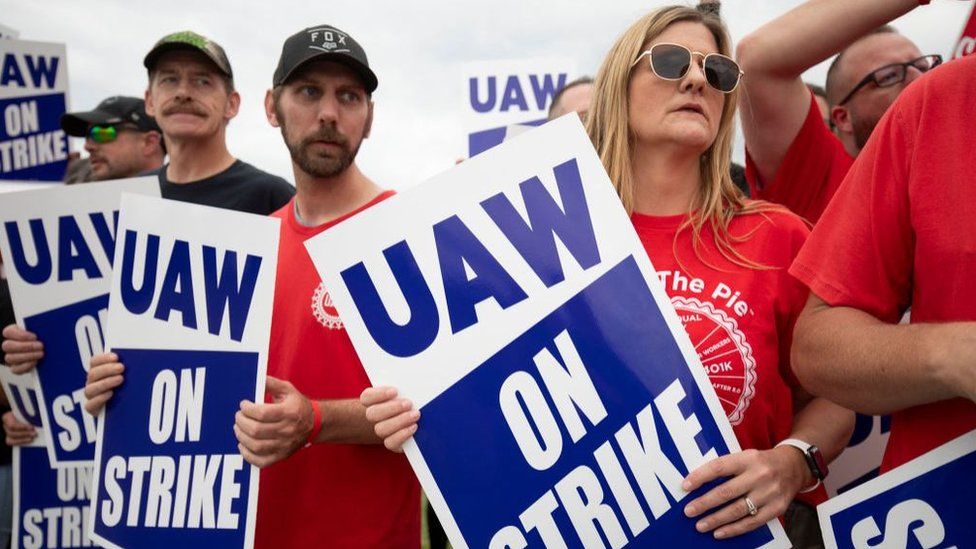

The UAW strike is now in its sixth week

By Natalie Sherman

Business reporter, New York

A strike by car workers in the US is costing General Motors roughly $200m (£164m) each week, the firm has said.

The carmaker revealed the hit as it released its latest results.

A row over pay and benefits led the United Auto Workers (UAW) union to begin strike action against GM, Ford and Stellantis in September.

More than 40,000 workers are now participating in the walkout - the first in the union's history to target all three firms at once.

General Motors executives told investors they were withdrawing profit forecasts for the year, because they could not predict how quickly the stand-off would conclude.

The carmaker said it had offered a "record" labour contract in an effort to help resolve the dispute, which is now in its sixth week.

The deal includes a 23% rise in pay, a reinstatement of pay adjustments tied to inflation and other benefits, according to details released by the company last week.

GM said the offer would leave the average worker with a salary of about $84,000 by the end of the four-year contract.

GM boss Mary Barra, who has been attacked by the union for receiving a pay package of more than $28m last year, said she knew that investors were "concerned about the impact of higher labour costs".

"Let me address this head on. It's been clear coming out of Covid that wages and benefits across the US economy would need to increase because of inflation and other factors," she said.

Ms Barra said the current GM proposal "rewards our team members but does not put our company and their jobs at risk".

In an update to union members last week, UAW boss Shawn Fain said negotiations were making progress but he believed there was "more to be won".

He urged workers to remain steadfast as the talks continue, telling them: "We've got cards left to play and they've got money left to spend."

The UAW represents more than 140,000 workers at GM, Ford and Stellantis.

GM said the strike, which the union has steadily expanded since its start, had cost it about $800m to date. It said it expected it to result in about $200m in lost production each week moving forward.

Those costs weighed on profits, which came in at $3.1bn over the July-September period, down about 7% from the same quarter a year ago.

However, the fall was not as steep as analysts had expected, coming as revenue rose more than 5% from last year to $44.1bn.

GM said it was working on trimming costs by $2bn.

It said it was postponing some of its plant openings, in part reflecting slower-than-expected sales of electric cars. It said it still hoped to make one million electric cars in the US by 2025.

1 year ago

29

1 year ago

29

English (US) ·

English (US) ·