ARTICLE AD BOX

Image source, Alamy

Image source, Alamy

Shares in Cineworld have fallen more than 60% as concerns mount that the world's second largest cinema chain is about to file for bankruptcy.

The company, which also owns the Picturehouse chain in the UK, is struggling under $5bn worth of debt.

Like other cinema chains, Cineworld was hit hard by the pandemic.

Cineworld recently said post-Covid customers levels were lower than expected and blamed "limited" film releases.

The Wall Street Journal reported that Cineworld is preparing to file for bankruptcy, sending its share price tumbling.

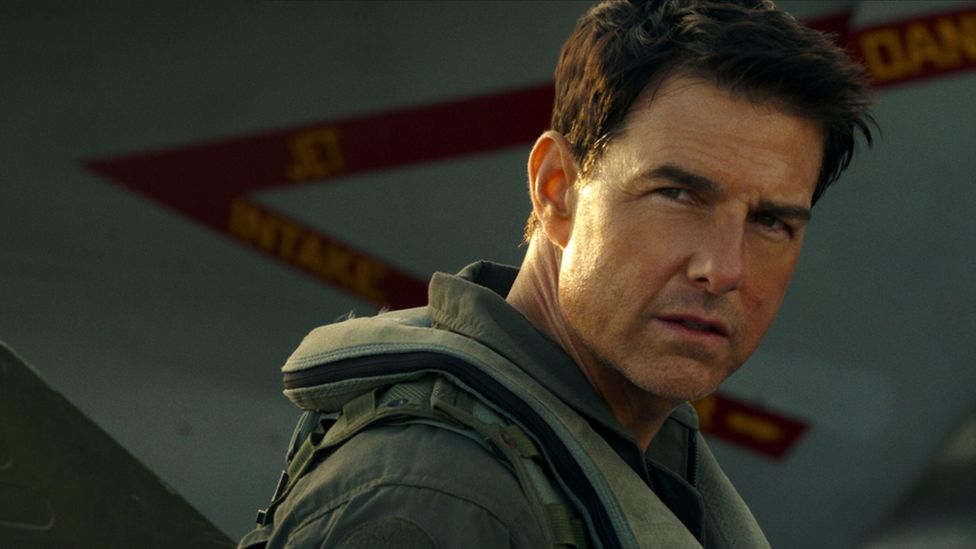

The firm had hoped blockbusters such as Top Gun: Maverick and Thor: Love And Thunder would draw audiences back after Covid restrictions.

But it said earlier this week: "Despite a gradual recovery of demand since reopening in April 2021, recent admission levels have been below expectations.

"These lower levels of admissions are due to a limited film slate that is anticipated to continue until November 2022 and are expected to negatively impact trading and the group's liquidity position in the near term."

The cinema industry was one of the worst hit sectors during the pandemic with many theatres closed for extended periods or operating at reduced capacity.

2 years ago

28

2 years ago

28

English (US)

English (US)