ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

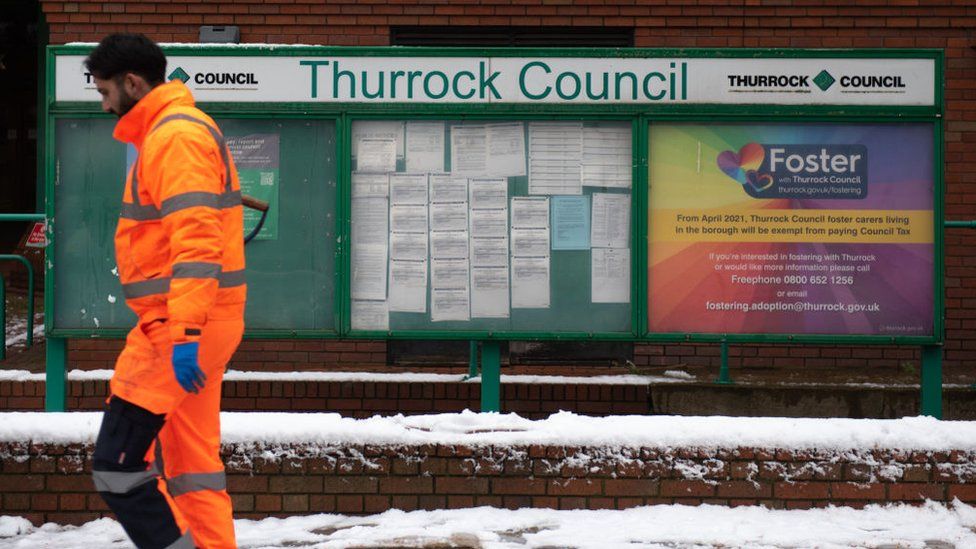

Thurrock Council, in Essex, has debts reaching £1.4bn

By Pilar Tomas and Paul Lynch

BBC Shared Data Unit

The debt mountain at UK councils has reached staggering levels, posing a risk to local services, the Public Accounts Committee has said.

Analysis shows UK councils owe a combined £97.8bn to lenders, equivalent to £1,100 per person, as of September.

Committee chairwoman Meg Hillier warned of an "extreme and long-lasting effect" if more councils go bust.

Council leaders say years of under-funding have forced them to invest in commercial ventures.

The comments come as town hall leaders have started to reveal stark draft budgets for the coming financial year.

Major cuts are being planned at Thurrock, Woking and Nottingham City Councils - all of which have effectively gone bust over the last two years, at least in part, due to failed commercial investments.

Leaders at Thurrock - which reported a financial black hole of £469m in 2022 and debts reaching £1.4bn - said they would have to make successive large cuts over the next three years to break even.

Dame Meg said there were driving factors behind councils borrowing large sums such as "squeezed spending power" and ageing populations.

But she said the amount spent paying off those debts risked hampering their ability to pay for vital services in the future.

"Some of the outlier examples of high local authority debt are staggering," she said. "And the impact on services for residents is liable to be extreme and long-lasting."

What are councils spending money on?

The BBC's Shared Data Unit found that, while the combined debt amounted to £1,141 per person, some councils had borrowed well over and above that level.

Your device may not support this visualisation

A total of 38 councils (10%) had no borrowing at all - but at Woking the debt figure was nearly £19,000 per person, the highest in the country.

The Surrey district council's debt is expected to rise to £2.6bn having committed to spending £605m on the Victoria Square skyscrapers in its town centre and £495m on the failed 1,000 home Sheerwater housing development scheme - which was canned in October.

The council, which has one of the the highest child poverty rates in Surrey, has proposed £12m in cuts next year, including the removal of all public toilets, a phased three-year closure of a swimming pool and the ending of funding for the Lightbox Theatre.

It said three leisure centres and 13 sports pitches were all threatened with having funding removed.

Government-appointed commissioners will remain in place for five years to run the council's financial affairs.

Image source, SOSiS

Image caption,Campaigners in Woking protest against the cuts

Treasurer of the Save Our Services in Surrey (SOSiS) campaign group Paul Couchman said the most vulnerable people in the town would bear the brunt of cuts.

"Parts of Surrey will become a wasteland and I don't think that's an exaggeration," he said.

"That's because there are people on the lower ends of the income scale and they are the users of the services being threatened.

"These are things like day care centres, transport for people with reduced mobility, hot lunchtime meals for older and vulnerable residents."

A spokesperson for the authority said it had published a recovery plan and had launched an external review into the investment decisions it made.

Image source, Leon Neal

Image caption,Woking's Victoria Square development contributed to its £1.8bn debt pile

Only two councils in the top ten with the largest debts per resident have issued section 114 notices, which limit them to essential spending and is often termed as "effective bankruptcy".

Birmingham, which issued a section 114 notice in September over a large equal pay claim, appears 43rd out of 386 councils and Nottingham only 36th.

In September, Credit Rating agency Moody's warned that other councils were likely to go bust due to a combination of poor governance, large borrowing levels and the falling value of commercial property.

Warrington, third in the table, had debts totalling £1.7bn in the last quarter.

The council's Labour administration has come under pressure from opposition councillors over its investments, which include the ownership of supermarkets in Greater Manchester, solar farms in York, Hull and Cirencester, a BT development being built in Salford and a third share of Redwood Bank.

An energy firm part-owned by the council collapsed in 2022.

But the council insists it has made "strategic, prudent, risk-based and long-term decisions", which have returned around £20m to the council each year for the last three years.

A spokesman said: "Our approach has always been in line with policy aims of economic regeneration, increasing affordable housing supply and climate change."

One of its most significant investments, the spokesman said, supported 6,000 local jobs, 150 businesses and generated rental income.

However, one of the town's Conservative MPs is concerned Warrington, like many other authorities, has exposed itself to too much risk.

Warrington South MP Andy Carter said: "Let's be clear, councils are there to provide public services to ensure that the potholes are filled and to ensure that there's social care for elderly and young, vulnerable children.

"That's their focus, and that's their expertise. But here we have senior council officers and council elected council members making decisions on investments with £1.8bn at stake.

"That, for me, is something that's really concerning."

Have councils been able to borrow too much?

The 2012 report - 50 ways to save: Examples of sensible savings in local government, signed by then Communities secretary Eric Pickles, encouraged town hall chiefs to pursue investments in order to stave off cuts.

Former Communities secretary Eric Pickles MP

Most of the borrowing for investment comes from the Public Works Loan Board (PWLB), an arm of the Treasury, which uses public money to hand out long-term loans at a low rate of interest.

Much of the borrowing has been used to fund improvements such as new headquarters, leisure centres and scout huts.

Some councils have millions of pounds worth of debt related to a legislation change in 2012 that allowed them to effectively buy out the social housing stock in their area.

But it is commercial investments, assets bought solely for the purpose of returning an income, that have proved the most controversial use of the loan money.

Jonathan Carr West, chief executive of the Local Government Investment Unit (LGiU), said such investments were not always "reckless" in intention.

"Many people have accused councils of gambling with public money," he said.

"It's certainly true we've seen some high-profile failures, the most obvious being Woking.

"They had investments that they were unable to service. At the same time, there are dozens and dozens of councils who have made these sorts of investments, who haven't gone bust.

"I think the reality is that it's very hard to tell. So you have councils with debts that way exceed their yearly revenue. But what they would say is, that's not the real question. The question is, can we afford to service those debts while delivering all of our services?"

Mr Carr West said part of the reason some councils had failed was limited accountability.

A current backlog in auditing - where external companies check how robust council budgetary plans are - has left the majority of English councils without their books checked for the past two years.

He also said scrutiny from the government had been lacking.

"Why isn't the PWLB putting a brake on this rather than allowing councils to keep borrowing and borrowing to dangerous levels?" he said.

The LGiU has repeatedly urged the government to reform the way councils are funding by allowing them to raise local taxes and allowing them to plan budgets over multiple years, the same as the NHS.

A spokesman for the Department of Levelling Up Housing and Communities (DLUHC) said the government had tightened rules on lending through the PWLB.

He said: "Councils are ultimately responsible for their own finances, but we are very clear they should not put taxpayers' money at risk by taking on excessive debt.

"The Levelling Up and Regeneration Act provides new powers for central government to step in when councils take excessive risk with borrowing and investment.

"We have also established the Office for Local Government to further improve accountability across the sector, which will help detect emerging risks and support councils to continue delivering key public services."

More about this story

The Shared Data Unit makes data journalism available to news organisations across the media industry, as part of a partnership between the BBC and the News Media Association.

1 year ago

33

1 year ago

33

English (US) ·

English (US) ·