ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

The UK's energy watchdog announced new plans to stop energy companies from going bust.

The proposals come after a string of high profile closures linked to high wholesale costs.

Planned measures include a cap on payments billed via direct debit, to "ensure credit balances do not become excessive".

Wholesale price rises of energy persist in the UK amidst record inflation and the Ukraine war.

Ofgem said it wanted to "prevent the kind of energy supplier failures we saw last year and to better protect consumers' money if they do fail."

Around 1.5 million UK households were affected when companies including Avro, People's Energy, Utility Point and MoneyPlus Energy ceased trading in September 2021.

Ofgem added that the closures "put unfair and unnecessary costs and worry onto consumers", as thousands scrambled to find out who would fill the gap left by their supplier.

Improving the financial health of energy suppliers over autumn and winter would help reduce the risk of failures, Ofgem added.

The proposed changes include making energy companies' supply chains more resilient, including better oversight over their "key assets".

Jonathan Brearley, chief executive of Ofgem said: "The energy market remains incredibly volatile and there are a number of huge geopolitical issues continuing to apply massive pressure.

"Ofgem is working hard to ensure energy suppliers shore up their positions so they can weather the ongoing storm."

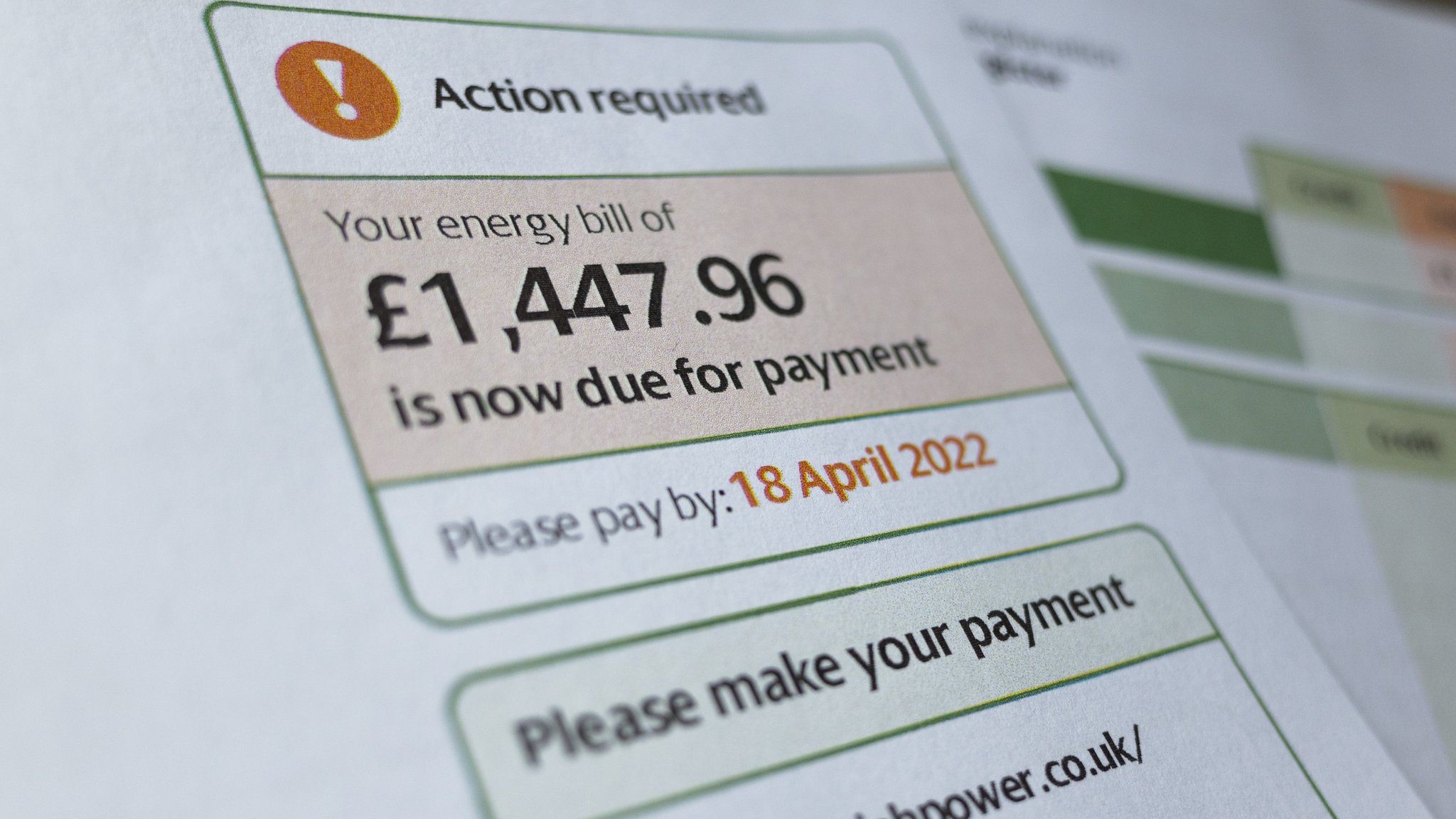

Included in the plans, which still needs to be finalised via consultation, is the tightening of the rules on the level of direct debits suppliers can charge customers, as "consumer credit balances... are used by some suppliers like an interest free company credit card."

The string of closures across the UK cost £94 per household, Ofgem says.

The typical UK energy bill is set to see a further rise of £800 in October.

Millions of domestic gas and electricity customers cover their bills with an identical direct debit payment every month.

When they've paid for more energy than they've actually used, a credit balance builds up.

About 30 companies have gone bust in the last year. Their customers were automatically transferred to new suppliers.

But, while their credit balances were honoured, the cost of doing so was covered by increasing everyone's bill.

Now Ofgem is proposing that companies hold more capital so credit balances are better protected, and the tab isn't picked up by all billpayers if that supplier collapses.

High credit balances have been a source of long-term frustration to customers, many of whom feel they simply provide a free loan to their supplier.

The regulator says these proposals should prevent excessive overpayments from ever building up.

The new plans would make sure that if a business does fail, it would pass on to its replacement the funds from consumers whose accounts are in credit.

The energy watchdog said it hoped the measures stopped "risky behaviour" from energy firms.

They mark the next step in Ofgem's wider plan in curbing energy failures, which already include stricter entry requirements for new suppliers, and carrying out regular "stress tests" - to ensure companies are financially fit to run.

Prices for oil and gas have soared in recent months, fuelled by the lifting of lockdowns and the Ukraine war, whilst the cost of living continues to rise as inflation hits 40-year highs.

2 years ago

63

2 years ago

63

English (US)

English (US)