ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

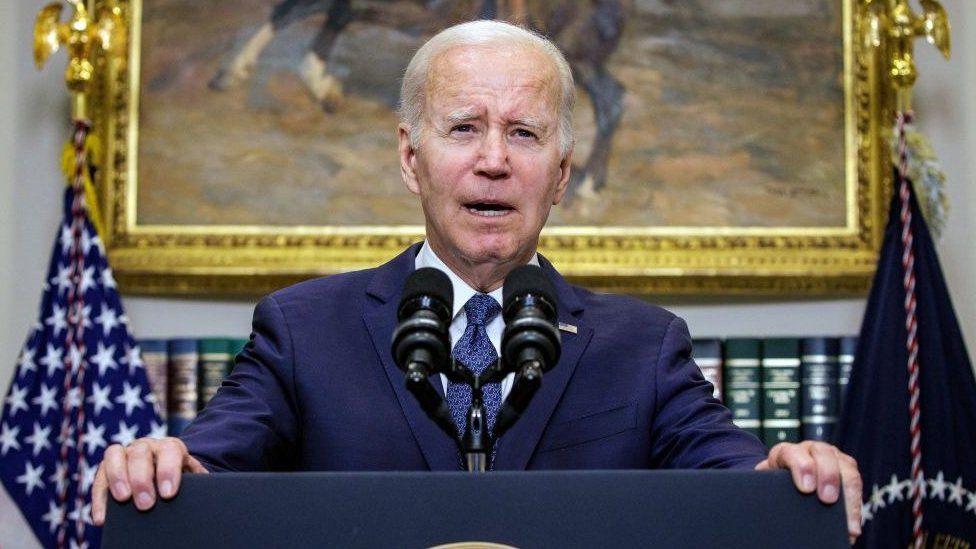

On Sunday, US president Joe Biden hailed the proposed deal as "good news"

US lawmakers are working to secure the votes needed to pass a bipartisan deal that will temporarily suspend the nation's debt ceiling.

Democrat and Republican leaders say they expect it will be approved, but some lawmakers have said they will vote against it.

The package must pass in the narrowly-divided House of Representatives before it is voted on in the Senate.

The US may default on its debt by 5 June without action being taken.

President Joe Biden called the agreement a "compromise" after a deal was reached over the weekend, while Republican House Speaker Kevin McCarthy said it was "worthy of the American people".

Negotiators have been working to sell the package on the Memorial Day federal holiday on Monday, according to US media, with both parties holding separate calls and meetings on the bill.

The House and Senate are expected to return to the Capitol on Tuesday. A vote on the bill in the House of Representative is scheduled for Wednesday, lawmakers said.

The proposed deal comes after long and bitter negotiations between Democrats and Republicans.

It includes suspending the debt ceiling until the first quarter of 2025, rather than raising it by a specific amount, as well as a cap on non-defence spending until 2024.

A text of the bill, titled the Fiscal Responsibility Act, was made public on Sunday.

That same day, Mr Biden told reporters that he does not believe his party made too many concessions in the agreement.

"This is a deal that is good news," Mr Biden said. "It takes the threat of catastrophic default off the table, protects our hard-earned and historic economic recovery."

Hakeem Jeffries, the Democratic House minority leader, told CBS that he believes his party will support it.

"I do expect that there will be Democratic support once we have the ability to actually be fully briefed by the White House," Mr Jeffries said on Sunday. "But I'm not going to predict what those numbers may ultimately look like."

But Ro Khanna, a California Democrat and member of the House Progressive Caucus, told NBC News on Sunday night that a "large majority" of House Democrats are "in flux" on whether they would lend their support.

Meanwhile, Mr McCarthy said on Sunday that he expects over 95% of House Republicans will support the bill.

In an opinion piece published in the Wall Street Journal late on Sunday, Mr McCarthy hailed the agreement as a hard-fought win for Republicans.

"We are changing the direction in Washington through a responsible debt-limit increase that cuts spending, saves taxpayers money and restores economic growth," he wrote.

During negotiations, Republicans had been seeking spending cuts in areas such as education and other social programmes in exchange for raising the $31.4tn (£25tn) debt limit.

As the 99-page proposed agreement was made public, some of the most conservative Republicans voiced concerns that the deal does not cut future spending enough. Republican Chip Roy of Texas said on Twitter that he and some others were going to try to stop it passing.

Some Democrats said they worried about changes in the agreement to the food stamps programme.

Aside from addressing the debt ceiling limit, the bill also proposed raising the age from 50 to 54 for those who are required to work in order to receive food benefits.

At the same time, it proposed eliminating work requirements for veterans and people who are homeless.

Republicans control the House by 222 to 213, while Democrats control the Senate by 51 to 49.

The Treasury had warned the US will run out of money if a deal is not passed.

The US must borrow money to fund the government because it spends more than it raises in taxes.

With the US dollar being the reserve currency of the world, a default would both upend the US economy and disrupt global markets.

2 years ago

42

2 years ago

42

English (US) ·

English (US) ·