ARTICLE AD BOX

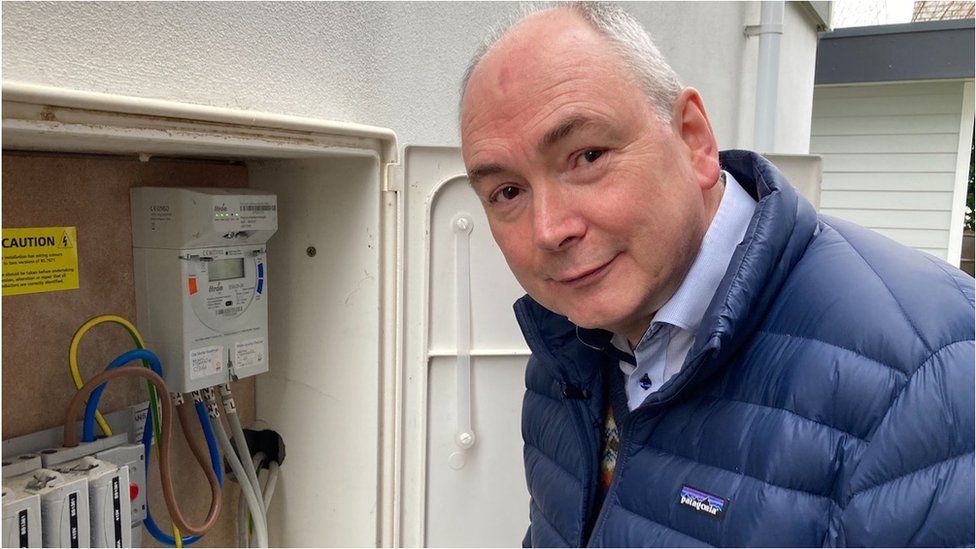

Patrick Langmaid says a smart meter reading led to the massive bill

By Kevin Peachey

Cost of living correspondent

Energy firms have been urged to tackle billing errors after customers told the BBC of wild inaccuracies, including a £244,000 bill for one month's supply.

Holiday park owner Patrick Langmaid said there was pandemonium in the office after the fee was taken via direct debit from his business account.

Victims question how such bills are ever sent, and why banks allow payment.

The cases emerged after artist Sir Grayson Perry spoke of his "bizarre" £39,000 bill.

The Turner Prize-winner told the BBC in December his difficulty in getting answers was "an interesting fable of the technological age".

Evidence that he was far from alone includes:

- The demand for nearly £250,000 from Mr Langmaid, about 100 times greater than his normal monthly bill

- A church charged £40,000 - with sufficient funds in its account only because it had been left from someone's will. The supplier said two errors led to the bill

- The owner of a property who received a "catch-up" bill for £16,000 which was eventually wiped

Dhara Vyas, deputy chief executive of Energy UK - which represents suppliers, said that millions of bills were sent out on a rolling basis, so mistakes were inevitable.

"Sometimes they are a human error. Sometimes they are an automation or a machine error," she said.

"It is really important that a supplier acts quickly to put it right, communicates well and tells the customer what they are doing, and also offers compensation where it is appropriate."

The invoice sent to Mr Langmaid

Suppliers have pointed to estimated meter readings as being among potential causes, but Mr Langmaid said his mammoth bill came from a "not very smart meter".

He has a complex of holiday lets called Martha's Orchard on the Cornish coast, and is accustomed to relatively high bills. Normally, he pays £2,500 a month.

But, it seems, the meter on one property clocked all the way around and back to zero, and the system suggested huge amounts of energy had been used. It generated the invoice automatically, and payment of £244,000 was collected from the business's account. The funds had been earmarked to buy new caravans and pay suppliers.

"That's the frightening thing," he said. "I have an issue with the energy company for doing it, the bank for allowing it to happen, and the whole direct debit system for allowing the payment to be taken without any safeguard."

The supplier, Total Energies, admitted that human error meant the hugely inflated invoice was not cancelled.

Image source, PA Media

Image caption,Sir Grayson Perry said his billing saga was bizarre

UK Finance, which represents the banking sector, said unless the payment went into an overdraft, it would not be stopped. Direct debits were only set up with sponsored, known companies, so were unlikely to raise any red flags under the banks' fraud checks as would happen with other unusual transactions.

"Energy companies have to tell you how much they are going to take out of your bank account and when," said Jana Mackintosh, director of payments at UK Finance.

So, she said, anyone with concerns about the amount or date should contact their energy company, and the bank to cancel the direct debit.

Not everyone will see the bill before the payment is taken, such as Castleton Baptist Church in South Wales, which was sent a paper bill for £44,000 but has no letterbox.

It took more than a month for the payment, which again was taken via direct debit, to be refunded.

Treasurer Nathan Evans, who said the regular bill was about £200 to £300, said: "Where are the checks and balances, especially when you consider what our bill normally is?

"The church only happened to have a large amount of money in the bank because we were left money in a will."

The supplier, SSE Energy Solutions, apologised and said an incorrect meter reading was submitted by a third-party operator and was missed by internal checks.

Image source, Maggie Boyd

Image caption,Maggie Boyd says it was stressful trying to get answers

Customers' frustration extends to finding a way to question bills when they arrive.

Maggie Boyd, aged 77, lives alone in a one-bedroom flat in a retirement complex in Scotland. She said her energy statement appeared to suggest she owed £41,000, and said she had spent "months of my life" trying to sort it out.

"I thought someone was winding me up," she said. "I've got a cat but I don't think she was working the dials of my [heating].

"It was laughable, but frightening at the same time and very, very stressful too."

A spokeswoman for her supplier, Ovo, said: "We're very sorry to Ms Boyd for any confusion and can confirm her account is accurate and up to date."

The balance is far smaller, and the company said it was offering support.

Paul Kelly, who was selling a house which he co-owned and had let out in Bristol, said he resorted to emailing his supplier's chief executive after spending months questioning a bill for £16,000. It was subsequently cancelled.

"I was passed between a number of people within a call centre, who were all perfectly nice, but just did nothing to actually resolve my complaint," he said.

E.On said he had been sent a large "catch-up" bill which had been based on estimated readings. "We have apologised to Mr Kelly for any inconvenience caused and we are glad his complaint has been resolved."

Wadebridge Foodbank was ultimately a beneficiary in Mr Langmaid's case

In addition to apologies, many suppliers are offering goodwill payments or compensation.

In Mr Langmaid's case, he was given compensation of £1,000, which he told his supplier he would donate to Wadebridge Foodbank, where he is a trustee.

Total Energies followed up with a donation of their own of £1,500 - leaving the charity's surviving winter fund £2,500 better off.

What can I do if I can't afford my energy bill?

- Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

- Pay what you can: If you can't meet your direct debit or quarterly payments, ask your supplier for an "able to pay plan" based on what you can afford.

- Claim what you are entitled to: Check you are claiming all the benefits you can. The independent MoneyHelper website has a useful guide.

1 year ago

63

1 year ago

63

English (US) ·

English (US) ·