ARTICLE AD BOX

Image source, PA Media

Image source, PA Media

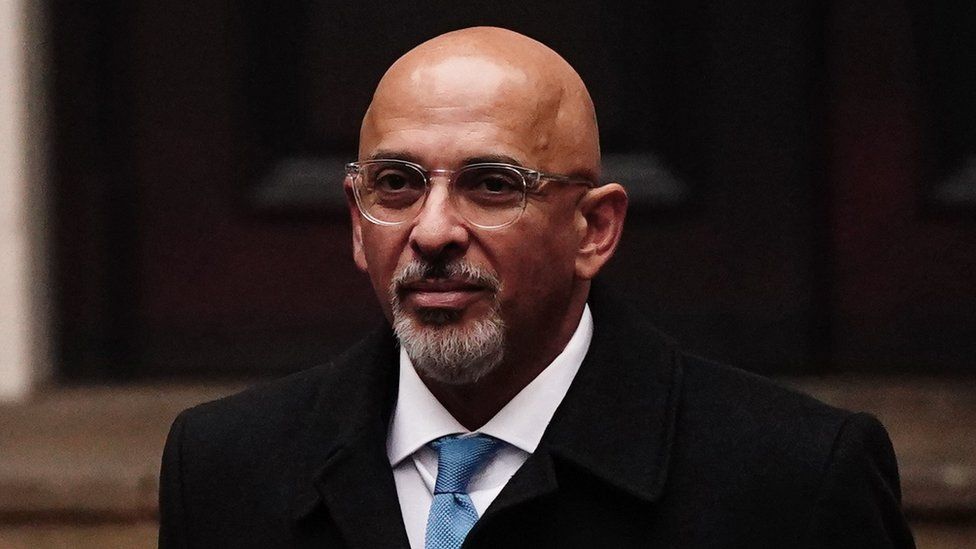

Conservative Party Chairman Nadhim Zahawi is under pressure over his tax affairs

There are no penalties for "innocent" tax errors, the boss of HM Revenue & Customs (HMRC) has told MPs.

Appearing before a Commons committee, Jim Harra was pressed on issues around the tax affairs of Nadhim Zahawi.

The Conservative Party chairman is facing calls to resign, after it emerged he paid a penalty to HMRC.

Mr Harra stressed he could not comment on individual cases but said penalties were not applied when someone had taken "reasonable care".

Mr Zahawi has said HMRC accepted the error over previously unpaid tax was "careless and not deliberate". He has also insisted he has "acted properly throughout".

The HMRC chief executive was due to be giving evidence to the Public Accounts Committee about managing tax compliance following the pandemic.

However, he also faced questions related to the tax arrangements of Mr Zahawi, who has come under growing pressure in recent weeks.

Whilst he would not comment on specific individuals, Mr Harra said: "There are no penalties for innocent errors in your tax affairs. So if you take reasonable care, but nevertheless make a mistake, whilst you will be liable for the tax and for interest if it's paid late, you would not be liable for a penalty.

"But if your error was as a result of carelessness, then legislation says that a penalty could apply in those circumstances."

The BBC understands Mr Zahawi resolved a multi-million pound dispute with HMRC last year, when he was chancellor.

According to the Guardian, he paid the tax he had owed, as well as a 30% penalty, with the total settlement amounting to £4.8m.

The tax was related to a shareholding in YouGov, the polling company he co-founded in 2000 before he became an MP.

Earlier this week, Prime Minister Rishi Sunak asked his independent ethics adviser, Sir Laurie Magnus, to look into whether Mr Zahawi broke ministerial rules over the issue.

Downing Street said it wanted the investigation to be completed "as quickly as possible" but that the timeline was a matter for the independent adviser.

Mr Harra said that if HMRC was asked by Sir Laurie to help with the inquiry "we will do so in any way we possibly can".

However, he said it would not normally publicly comment on someone's tax affairs, even if the individual had given their consent.

1 year ago

43

1 year ago

43

English (US)

English (US)