ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

The elite club of US companies worth more than $1tn (£800bn) officially has a new member: US chipmaker Nvidia.

The share price of the California-based firm shot past $412 on Tuesday, having risen by more than 30% since last week.

It comes after the firm shocked analysts, forecasting "surging demand" due to advances in artificial intelligence (AI).

Apple, Amazon, Alphabet and Microsoft are among the other publicly traded US firms worth more than $1tn.

Founded in 1993, Nvidia was originally known for making the type of computer chips that process graphics, particularly for computer games.

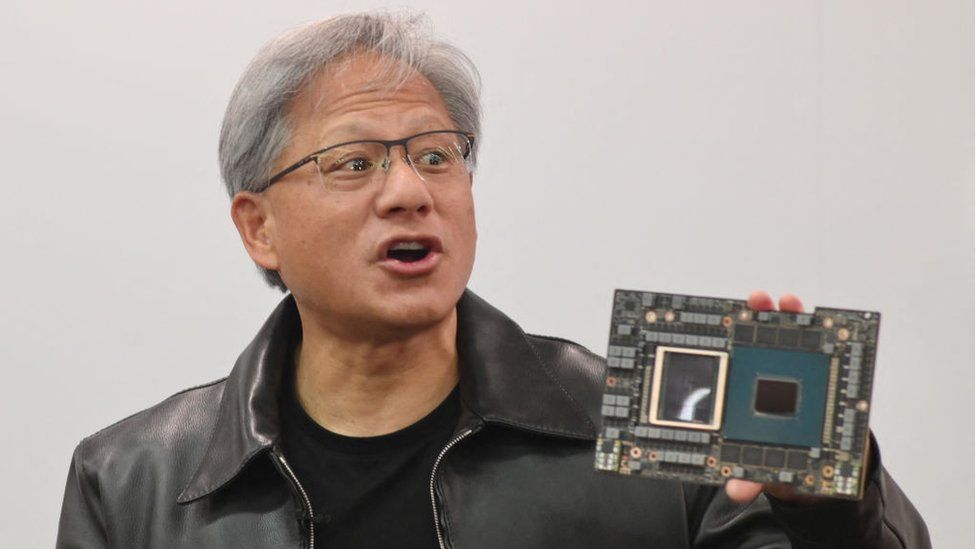

The firm's affable co-founder Jensen Huang took a punt by investing in added functionality for Nvidia chips long before the AI revolution - a long game that appears to have paid off.

Its hardware underpins most AI applications today, with one report suggesting it has cornered 95% of the market for machine learning.

ChatGPT, the chatbot that sparked AI fervour with its launch last year, was trained using 10,000 of Nvidia's graphics processing units (GPUs) clustered together in a supercomputer belonging to Microsoft.

Analysts say the company is well positioned as AI ushers in the next wave of tech advances.

"We view Nvidia at the core hearts and lungs of the AI revolution," Wedbush Securities analyst Dan Ives wrote last week, after the firm's update to investors.

The firm said last week it expected to bring in $11bn in sales in the three months to July - almost 50% more than analysts had expected.

Geir Lode, head of global equities at Federated Hermes, said the magnitude of the recent leap in Nvidia's share price was "an astonishing surprise even to techno-optimists".

"Artificial intelligence is the next super charged growth area, and we expect this is just the beginning," Mr Lode said. "We know growth will be there, but valuations can be hard to justify."

Though Nvidia boomed during the pandemic, its overall revenue growth was flat last year, while profits were cut in half.

Rivals AMD and Intel are racing to develop their own offerings, while start-ups are also emerging.

There are also questions about whether the firm can keep up with demand, as well as ethical issues to explore, such as whether Nvidia should vet the AI products it produces chips for amid concerns about the impact of AI on society.

"Nvidia is the one with the target on its back that everybody is trying to take down," Kevin Krewell, an industry analyst at Tirias Research, told the BBC recently.

In the past, investors have not hesitated to sour on former favourites.

Facebook-owner Meta, which joined the $1tn club in 2021, was booted out just a few months later, as its shares lost roughly three quarters of their value. It is valued at about $670bn today.

Communications giant Cisco was also seen as a likely trillion dollar club member during the dotcom tech bubble of the late 1990s. But that bubble burst and the firm is valued at about $200bn today.

1 year ago

32

1 year ago

32

English (US) ·

English (US) ·