ARTICLE AD BOX

By Kevin Peachey

Personal finance correspondent, BBC News

Image source, National Tradiing Standards

Image source, National Tradiing Standards

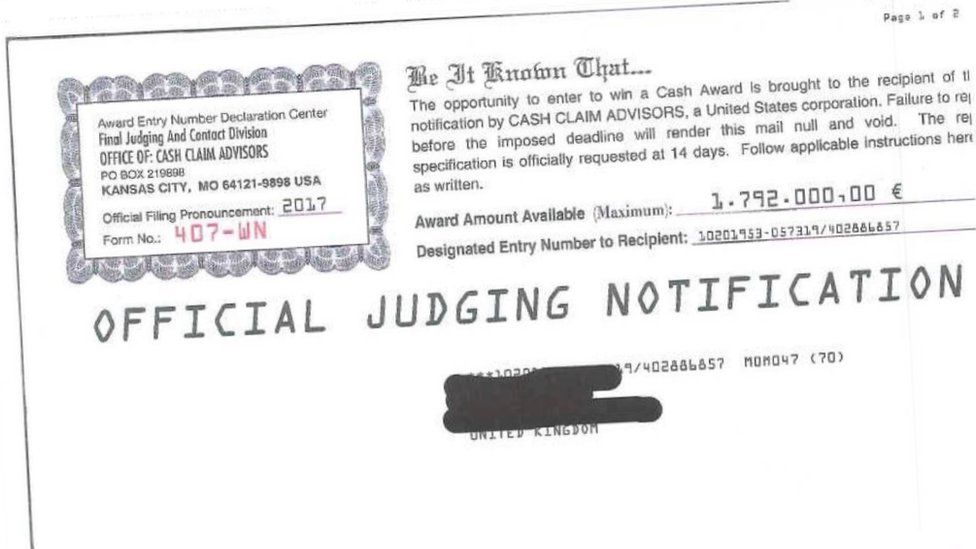

One of the scam letters sent to potential victims

Victims of an international scam in which elderly and sick people were enticed to play for cash prizes that were never won are to receive payouts.

Fraudsters in the US tricked people into paying upfront fees for guaranteed cash prizes that were never paid.

About 3,500 UK victims will be refunded a share of £530,000 after a landmark case and four years of investigation.

The compensation is funded after the authorities claimed cash, luxury homes and a Bentley from the con artists.

"Falling victim to a scam can have a huge emotional impact on individuals so I'm delighted that we can use the proceeds of these crimes to provide compensation to thousands of UK victims," said Louise Baxter, head of the UK National Trading Standards scams team.

Victims will be refunded 20% of their losses.

Prizes that were never won

Vulnerable potential victims were identified by the fraudsters from so-called "suckers lists" circulated by fraudsters and sent scam letters suggesting they would receive "guaranteed" large cash prizes. They were targeted because they were elderly and living alone, or had long-term health conditions.

More than seven million letters were estimated to have been sent to UK addresses in the four years from 2014.

At the heart of the scam was a demand for an upfront fee of between £25 and £40 to release the "prize". Some people paid the fee several times, and some lost many hundreds of pounds, before realising there was no prize.

Image source, Getty Images

The nerve-centre of the operation was discovered by UK investigators from National Trading Standards to be in Kansas, in the US.

Three men - Kevin Brandes, William Graham and Charles Floyd Anderson - and their companies had sent tens of millions of deceptive letters to individuals around the world, in the so-called Next Gen sweepstakes scheme. Alongside it, they ran a classic and vintage car sales operation and held millions of dollars in a variety of bank accounts, trading standards said.

The US Federal Trade Commission took action and the trio agreed to forfeit $30m (£25m) in cash and assets, nearly all of which will be used to compensate victims around the world. Among the assets were two luxury homes, a yacht and a Bentley car.

Landmark case

This will now become the first compensation scheme across international borders of its kind in the UK.

Victims will be refunded 20% of their losses. They will be contacted by local trading standards officers and given their payouts via a pre-loaded card, which they can spend in shops or pay into their bank accounts.

"This investigation and approach to obtaining the proceeds of crime sends a clear message that fraudsters, wherever they are based, can be caught," said Lord Michael Bichard, who chairs National Trading Standards.

"It is testament to the work of the National Trading Standards scams team, working alongside local trading standards officers, that money will be returned to so many victims."

Many of those targeted would have been repeat victims of scams, and often too worried or ashamed to report it. They would now be specifically helped by trading standards officers.

National Trading Standards, which was commended by the US Attorney General for its role in the investigation, said that there had been a "significant drop" in the volume of fraudulent mail reaching the UK from the US as a direct result of the case.

However, warnings about scams continue, with the rising cost of living and energy bills providing criminals with new opportunities to steal victims' personal and financial information.

Cifas, the fraud prevention organisation, said it was seeing a rise in phishing emails claiming to be from utility companies offering savings on energy bills, as well as offering fuel vouchers, fake jobs and money-making opportunities. These emails were becoming increasingly sophisticated, as were the websites which were used to collect people's personal information.

Mike Haley, chief executive of Cifas, said: "Everyone is at risk of being targeted by fraudsters, but the current economic crisis is making consumers even more vulnerable."

2 years ago

45

2 years ago

45

English (US) ·

English (US) ·