ARTICLE AD BOX

By Kevin Peachey

Personal finance correspondent, BBC News

Speculation is mounting over a change in policy determining the next rise in the state pension.

During the summer, Chancellor Rishi Sunak hinted that the government was prepared to break the triple lock - a manifesto promise governing state pension rises - owing to the unique situation the pandemic has caused.

Now the Treasury Committee has stressed to the chancellor that "the triple lock is unsustainable in its current form".

What is the triple lock and how does it work?

At present, the state pension increases each year in line with the rising cost of living seen in the Consumer Prices Index (CPI) measure of inflation, increasing average wages, or 2.5%, whichever is highest.

This is known as the triple lock, and it is a Conservative manifesto pledge for the five years of this Parliament.

Official forecasts suggest that the increase in average earnings will be the highest of these three, by a considerable margin.

Men and women are currently entitled to the state pension at the age of 66, but the age at when people qualify for the payments is scheduled to rise.

What impact has Covid had on the triple lock?

As people come off furlough and return to full pay, this is recorded as a large rise in average earnings. Job losses have also affected those in low-paid work too.

This leads to a unique situation, and one which economists describe as an anomaly.

Predictions by the Bank of England suggest that annual average earnings for the period relevant for the triple lock could go up by 8%, which would normally trigger an equivalent rise in the state pension.

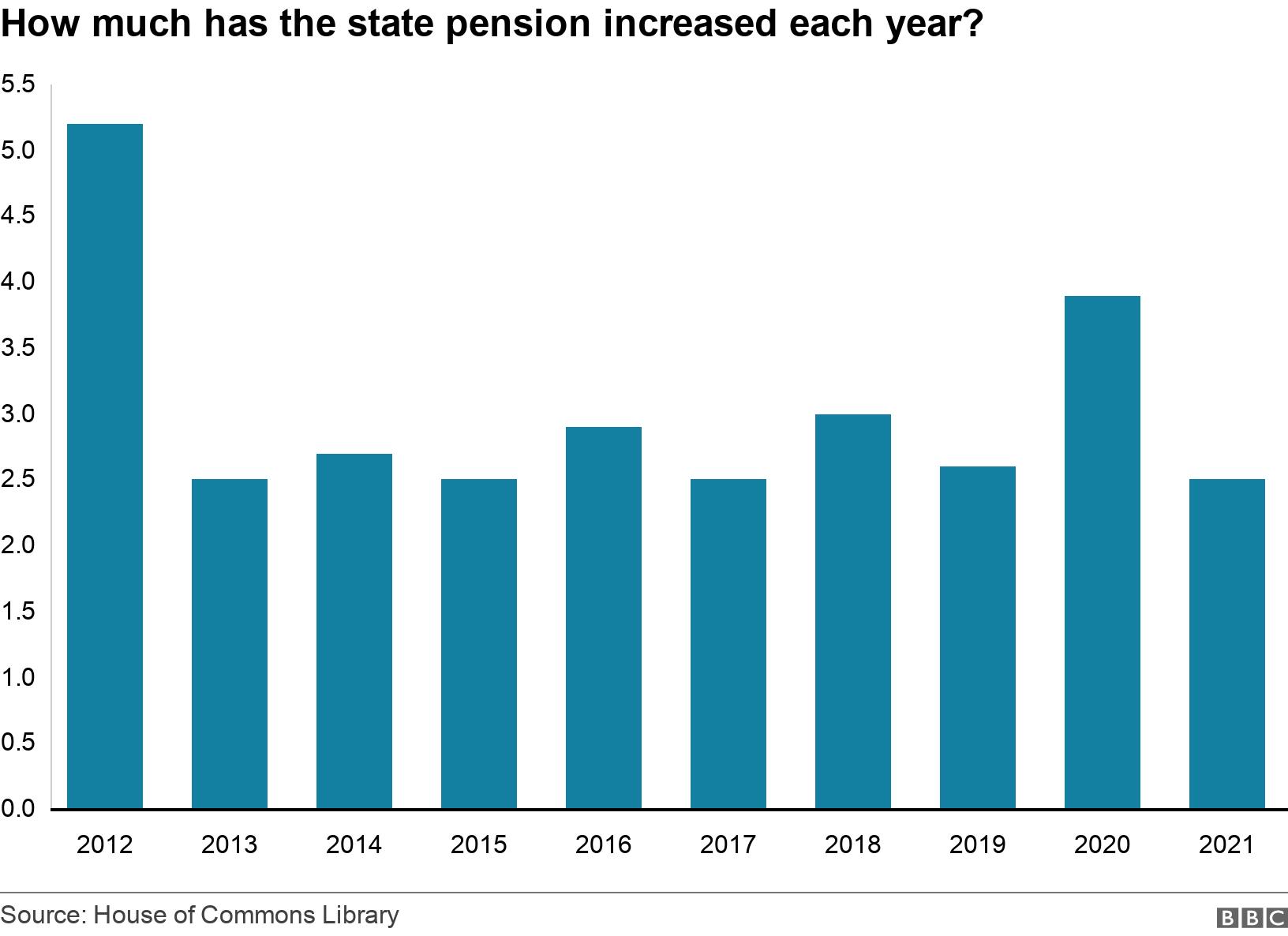

That is considerably higher than rises seen under the triple lock in the past decade.

Could the triple lock change?

It is a manifesto promise, but the chancellor has hinted that the triple lock could be broken to ensure "fairness for pensioners and taxpayers". In a letter to the Treasury Committee, he says he is aware of "legitimate concerns" about potentially artificially inflated earnings numbers leading to a big rise in the state pension, but that the forecasts remain uncertain.

There is no reason in law why the chancellor cannot change the way earnings are judged in the triple lock system. He may also be tempted to package any change with a National Insurance rise earmarked to pay for social care.

The triple lock guarantee was introduced by the Conservative-Liberal Democrat coalition to ensure pensioners did not see any rise in their state pension being overtaken by the rising cost of living, nor that the working population would be see a much bigger income rise than them each year. It has proved to be a very expensive policy.

- The full, new flat-rate state pension (for those who reached state pension age after April 2016) is £179.60 a week

- The full, old basic state pension (for those who reached state pension age before April 2016) is £137.60 a week. They may also get a Pension Credit top-up.

Many charities representing the elderly argue the state pension is still relatively little to live on, and is still low alongside international comparisons.

For some pensioners, particularly women, it may be their only source of income as they had little or no opportunity to build up a private pension.

What happens next?

The official figures on rising wages, which generally govern that leg of the triple lock, will be published in mid-September.

The government may decide to announce a policy before that on the calculation for next April's state pension rise.

3 years ago

80

3 years ago

80

English (US)

English (US)