ARTICLE AD BOX

Image source, Reuters

Image source, Reuters

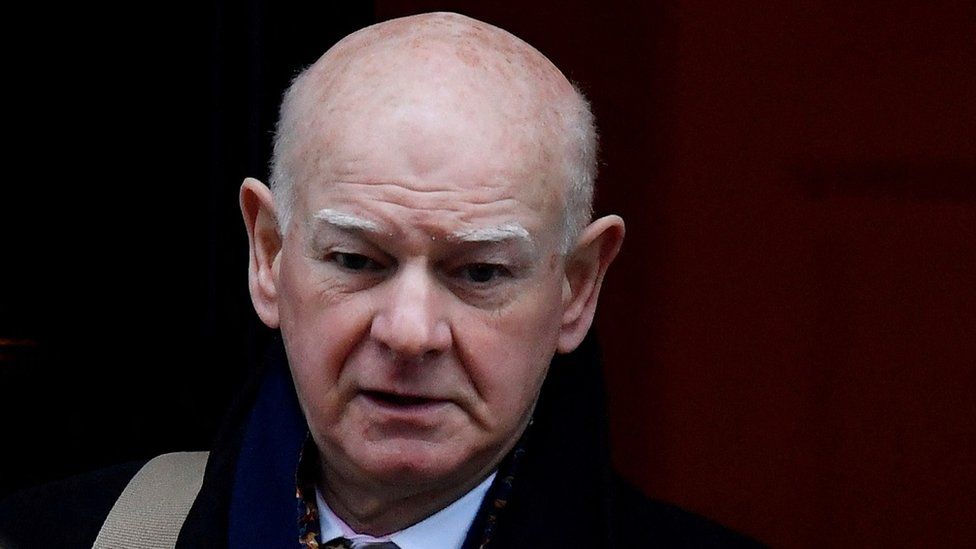

Sir Howard Davies is the chair of the NatWest group

By Michael Race

Business reporter, BBC News

NatWest's chair has said he does not believe it is "that difficult" for people to get on the UK housing ladder.

"You have to save, and that's the way it always used to be," Sir Howard Davies told the BBC's Today programme.

He said he recognised people were "finding it difficult to start the process", but warned of "dangers" in "very easy access to mortgage credit".

His comments come as mortgage interest rates have started to fall, but overall remain higher than in recent years.

The average price of a property in the UK is currently £287,105, according to figures released on Friday by Halifax, the UK's biggest mortgage lender.

Typically, borrowers need a deposit worth at least 10% of a property's value to get a mortgage, so with the gap between house prices and average earnings widening over decades, saving enough money to put down initially is the biggest hurdle for many hoping to buy a home.

It is also one factor in why the average age of a first-time buyer has risen to 32.

Asked when he thought it would be easier for people to get on to the property ladder in the UK, Sir Howard said: "Well, I don't think it's that difficult at the moment. You have to save, and that's the way it always used to be."

Pressed further on his reasoning, the NatWest chair admitted people had to save more, but said it was also due to fundamental changes in the housing market seen in the wake of the financial crisis.

"What we saw in the financial crisis was the risk of having people being able to borrow 100% and then suffering severe falls in the equity value of their houses and having to leave and having a bad credit record so there were dangers in very very easy access to mortgage credit," Sir Howard added.

While people have to save more cash for a deposit, the rising cost of living has hindered many people's ability to set money aside with energy bills and food costs soaring in recent years.

Inflation - the rate prices rise at - hit a 40-year high in 2022 and as a result, the Bank of England has increased interest rates to try to slow it down, making the cost of borrowing money more expensive.

Renters hoping to save for their own home have also seen their monthly outgoings rise sharply, with a new let costing £1,201 a month on average, according to Zoopla. High demand has driven the increase, while supply has also narrowed with some private landlords selling up as a result of higher mortgage rates.

Research has also shown that parents have become source of funds to enable their children to get a deposit.

But there are signs pressure on mortgage-holders is easing, with several big lenders announcing cuts in recent days, though many homeowners coming off fixed-rate deals will face big repayment increases.

On Friday, the average two-year fixed rate was 5.83%, while a five-year deal was 5.43%, according to financial information service Moneyfacts.

1 year ago

32

1 year ago

32

English (US) ·

English (US) ·