ARTICLE AD BOX

BBC

BBC

Tesco is one of a number of supermarkets that matches some prices to Aldi

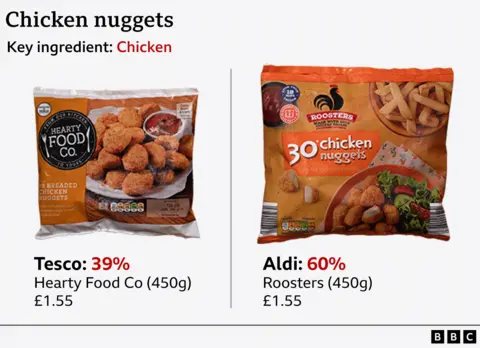

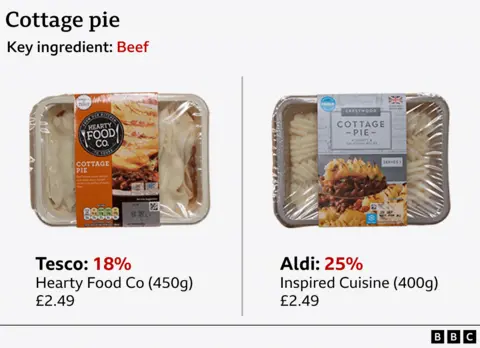

Dozens of Tesco products price-matched to Aldi - such as chicken nuggets, cottage pie and blackcurrant squash - are not like-for-like, BBC Panorama has found.

In the case of chicken nuggets, the Tesco product contained 39% chicken compared with 60% in the Aldi one.

Of 122 Tesco products, 38 - nearly a third - had at least five percentage points less of the main ingredient than the Aldi products they had been matched to.

Twelve Tesco products were found to have more of the main ingredient.

Tesco told the BBC it constantly reviews the quality of its products and has clear processes in place to ensure its price-match products are comparable to Aldi.

It also said a higher proportion of any one ingredient does not necessarily mean it is better quality.

Consumer expert Kate Hardcastle says Panorama's findings are an example of “value engineering” which involves changing quantities of ingredients to reduce the price.

Discount supermarkets like Aldi and Lidl have thrived as shoppers have adapted to the higher cost of living.

Aldi’s low prices have helped it overtake Morrisons as the UK’s fourth biggest supermarket.

Tesco is not the only supermarket to offer products priced to match Aldi.

Sainsbury’s, Morrisons and ASDA offer similar ranges, but Panorama found no clear evidence of a pattern of consistent differences in the proportions of main ingredients in their goods compared with the Aldi versions.

Tesco matches Aldi’s prices on about 700 items out of its 30,000 product lines. They are usually low-priced everyday goods.

Ingredients listed on 122 Tesco products price-matched to Aldi were analysed by Panorama in August.

We found that Tesco chicken kievs, part of the supermarket's Hearty Food Co range, had 44% chicken, compared with 57% in the Aldi equivalent. In the same range, Tesco cottage pie had 18% beef, whereas Aldi Inspired Cuisine Cottage Pie had 25%.

In the case of Tesco Hearty Food Co chicken nuggets, there was 39% chicken listed on the ingredients, but in Aldi Roosters Chicken Nuggets there was 60%.

A can of Tesco Stockwell & Co Chilli Con Carne lists beef as making up 15% of its ingredients, while in Aldi Bramwells Chilli Con Carne the figure is 27%.

Meanwhile, Tesco No Added Sugar DS Apple Blackcurrant Squash had 6% fruit juices from concentrate, while Aldi Sun Quench Double Strength Apple & Blackcurrant Squash had 20%.

Reducing quantities of the most expensive element in a product - such as meat in a ready-meal lasagne - can make a significant difference to prices, says consumer expert Kate Hardcastle.

“It's only when you [customers] flip it over and look at that tiny, tiny, font size to see you're not getting the same deal,” she explains.

But not all of the Tesco price-match products analysed by Panorama had less of the main ingredient than Aldi equivalents.

Twelve of the 122 Tesco comparisons had at least five percentage points more than Aldi’s. These included:

- Hearty Food Co 10 Fish Fingers had 64% Alaska pollock, compared with Aldi’s Everyday Essentials Fish Fingers which had 58%

- Tesco’s Eastmans Coleslaw had 57% of cabbage, while Aldi’s The Deli Creamy Coleslaw had 47%

- Also in the Eastman range, Reduced Fat Houmous had 62% of cooked chickpeas, whereas Aldi’s The Deli Reduced Fat Houmous had 55%

Tesco said: “Since we launched our Aldi Price Match four years ago it has proved very popular with customers.”

It added that all of its products carry information about ingredients so customers can make informed choices.

Supermarket Deals: How Good Are They?

As the cost-of-living squeeze continues to affect many, supermarkets say they’re doing what they can to help us save money, offering discounts and promotions. But just how good are these deals?

Watch now on BBC iPlayer or on BBC One on Monday 23 September at 20:00 (20:30 in Northern Ireland)

Aldi’s most recent figures, published earlier this month, showed its pre-tax profits more than tripled to a record £536.7m in the year to the end of December 2023, driven by an extra £2.4bn in sales.

Price rises and new store openings drove much of the rise in earnings, but it also attracted new customers. However, the chain is now growing at a slower rate than most of its big rivals, including Lidl.

This time last year, Aldi was the fastest-growing supermarket, according to industry data, but it has since lost ground in market share as competitors have fought back.

It has more than 1,020 stores across the UK and employs 45,000 people.

Tesco’s Stockwell & Co Chilli Con Carne has 15% beef, while its Aldi comparison product has 27%

The vast majority of the products Aldi and Lidl sell are own-label.

Last year, Giles Hurley, Aldi’s boss in the UK and Ireland, told the BBC products sold under a supermarket's own name now make up more than half of everything shoppers buy, by value.

"If you look in volume terms that figure is much bigger and at the moment own-label products are growing at twice the rate of branded goods," Mr Hurley said.

"Why would [shoppers] go back?"

Meanwhile, Tesco, the UK's biggest supermarket chain, reported in April that its pre-tax profits hit £2.3bn, up from £882m, while sales rose by 4.4% to £68.2bn in the year to 24 February.

It has 2,800 stores and employs 330,000 staff.

7 months ago

27

7 months ago

27

English (US) ·

English (US) ·