ARTICLE AD BOX

Image source, Getty Images

Image source, Getty Images

By Mariko Oi

Business reporter

British microchip designing giant Arm has filed to sell its shares in the US, setting the stage for what could be the biggest stock market listing this year.

The Cambridge-based firm is reportedly aiming to raise up to $10bn (£8bn).

In a blow to the UK, the company said in March that it did not plan to list its shares in London.

Arm was bought in 2016 by Japanese conglomerate Softbank in a deal worth £23.4bn. At the time Arm was listed in London and New York.

Softbank said it had "confidentially submitted a draft registration statement" for the listing to the US Securities and Exchange Commission (SEC).

The announcement did not reveal how much it planned to raise or when the share sale might take place.

The firm was seeking to raise between $8bn and $10bn through the listing this year on the technology-heavy Nasdaq platform, according to reports.

In March, Arm said did not plan to pursue a London Stock Exchange listing.

Reports in January said that UK Prime Minister Rishi Sunak had restarted talks with Softbank about a possible UK listing.

However, Arm said it had decided a sole US listing was "the best path forward".

The registration shows that Softbank is pushing ahead with the multi-billion dollar sale despite difficult conditions in the global financial markets.

The number of stock market listings has fallen sharply since Russia's invasion of Ukraine. At the same time, shares in major technology companies have fallen in the wake of the pandemic.

Softbank said the listing was "subject to market and other conditions and the completion of the SEC's review process."

Last year, Softbank called off its planned $40bn sale of Arm to technology group Nvidia after facing regulatory hurdles in the UK, US and EU.

Sometimes referred to as the "crown jewel" of the UK's technology sector, Arm was founded in Cambridge, England, in 1990.

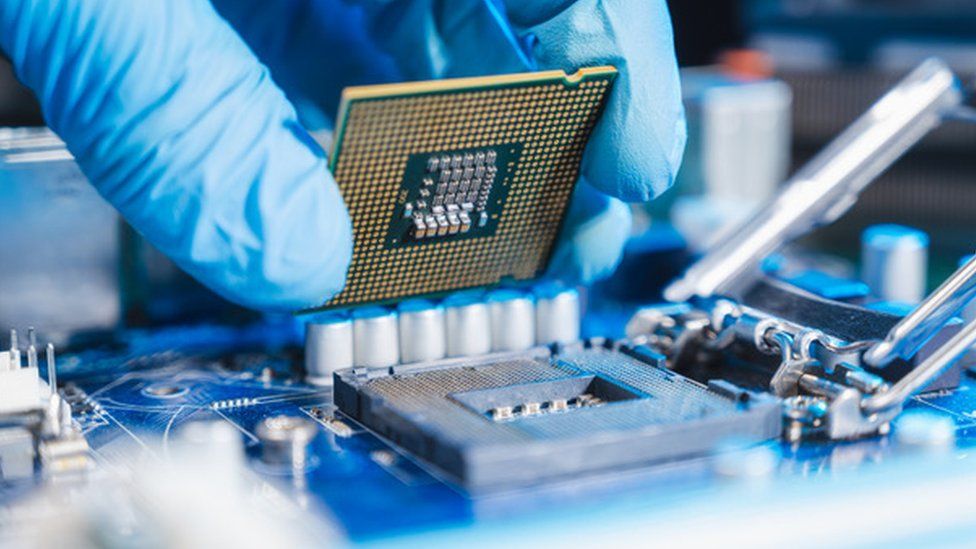

Its chip designs are used by manufacturers like the Taiwan Semiconductor Manufacturing Company and companies like Apple and Samsung to build their own processors.

After an acute shortage of semiconductors during the pandemic, the chip making industry has faced slowing demand.

Last week, US chipmaking giant Intel reported its largest quarterly loss in the company's history, while South Korean rival Samsung posted a 96% fall in its profits.

A successful stock market listing of Arm would be welcome news for its owner Softbank. Its Vision Funds have been hit by losses due to the declining valuations of many of its investments in technology startups.

2 years ago

53

2 years ago

53

English (US) ·

English (US) ·