ARTICLE AD BOX

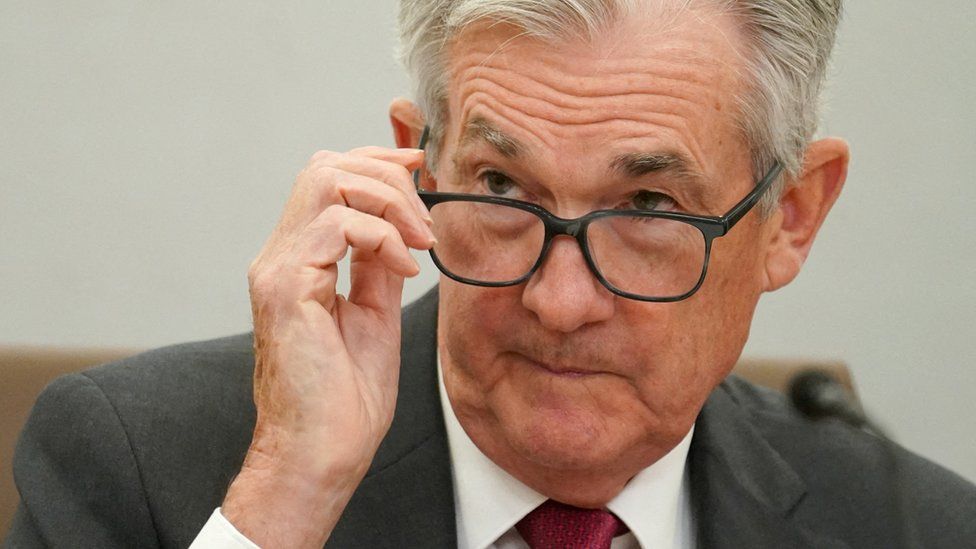

Image source, Reuters

Image source, Reuters

The US central bank has approved another sharp rise in interest rates as it wrestles to rein in fast rising prices.

The Federal Reserve said it was raising its key interest rate by 0.75 percentage points, lifting it to its highest rate since early 2008.

The bank hopes pushing up borrowing costs will cool the economy and bring down price inflation.

But critics are worried the moves could trigger a serious downturn.

The latest increase takes the benchmark lending rate to 3.75% - 4%, a range which is the highest since January 2008.

Many other countries are moving along with the US to raise borrowing costs, as they grapple with their own inflation problems.

In the UK, the Bank of England started raising rates last year but has so far opted for smaller hikes than the Fed. The Bank of England is expected to announce its own 0.75 percentage point hike on Thursday - the biggest such move since 1989.

The sharp rise in borrowing costs has already started to cool some parts of the economy, such as housing.

But economists say more economic slowdown is necessary if inflation is to return to the 2% level considered healthy.

"There is always the hope of painless, immaculate disinflation," said economist Willem Buiter, a former member of the Monetary Policy Committee of the Bank of England who is now an independent economic advisor. "Unfortunately there are very few historical episodes that fit that picture".

"This is not going to be a pleasant year," he added.

Inflation - the rate at which prices rise - hit 8.2% in the US last month, continuing to fall after reaching 9.1% in June - the highest rate since 1981.

A decline in energy prices has helped ease the pressures, but the cost of groceries, medical bills and many other items is still rising.

2 years ago

34

2 years ago

34

English (US) ·

English (US) ·