ARTICLE AD BOX

Image source, Reuters

Image source, Reuters

The government is under pressure to reverse changes to corporation tax, which were announced in the mini-Budget less than a month ago.

What is the tax and how might it change?

How much is corporation tax and who pays it?

Corporation tax is paid to the government by UK companies and foreign companies with UK offices.

They are currently charged 19% of their profits. Profits are the amount of money a company makes, minus any money it has spent.

Since 2015 there has been a single rate of corporation tax. Before then, there was a main rate and a lower rate for companies with profits under £300,000 a year.

The rate of corporation tax was cut rapidly by the Conservatives - from 28% when the party came to power in 2010, to 19% in April 2017.

What is happening to corporation tax?

Former chancellor Rishi Sunak announced in March 2021 that the rate of corporation tax was going up. It was due to rise from 19% to 25% in April 2023.

He said it was fair to ask companies to contribute more after the government spent billions of pounds supporting them during the Covid pandemic.

However, during the Tory leadership campaign Liz Truss pledged to reverse Mr Sunak's decision. She said: "I think it's vitally important that we're attracting investment into our country."

On 23 September, then Chancellor Kwasi Kwarteng announced that corporation tax would indeed stay at 19%.

The government estimated keeping corporation tax at 19% would cost £19bn a year by 2026-27. However, that forecast has not had the usual checks by the independent Office for Budget Responsibility (OBR) - which provides economic advice to the government.

The extent of the unfunded tax cuts announced in the mini-budget - which also included changes to National Insurance and the top rate of tax - caused problems on financial markets.

The cost of borrowing for the government and for mortgages both rose considerably and the pound fell against the dollar.

As a result, the government is now under pressure to reverse some of its decisions - including those on corporation tax.

Would lowering corporation tax help the economy?

The £19bn cost doesn't take into account any extra money made by the government if firms make higher profits.

The idea of cancelling the increase was that it would encourage more companies to come to the UK and invest more money.

It was hoped the economy would grow and the government would receive more money even though the tax rate was lower.

However, economic think tank the Institute for Fiscal Studies said that effect would not be enough for the tax cuts to pay for themselves.

What do other countries do?

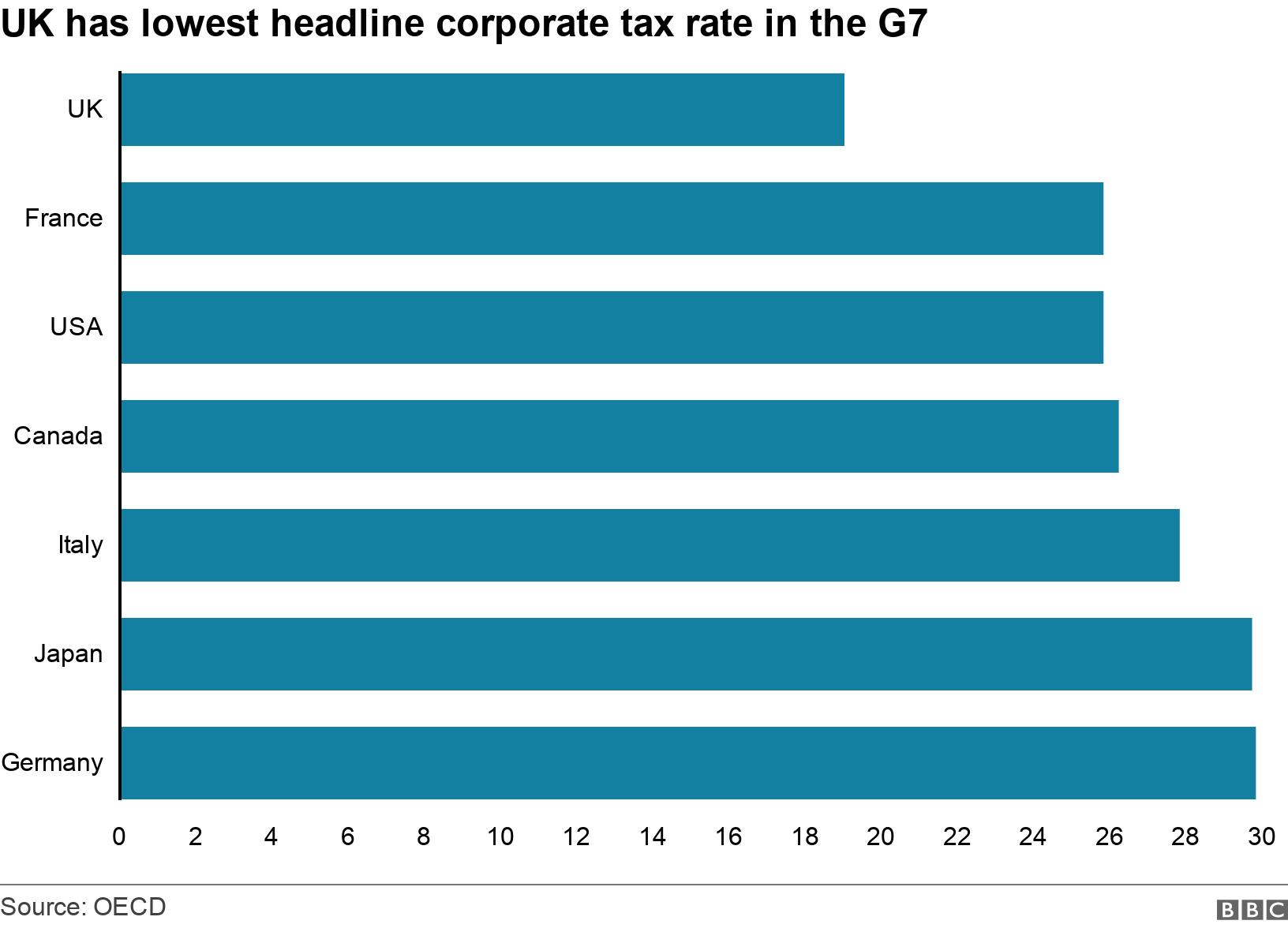

The government says that keeping the corporation tax rate at 19% will mean it is "significantly lower than G7 counterparts".

The G7 is a group of countries with big, industrialised economies.

The next lowest country for corporation tax is France at 25.8% - higher than the UK even if the increase had gone ahead in April.

But this chart doesn't tell the full story.

Governments leave loopholes. Companies may pay less tax, if they invest in their businesses for example, or set up in certain parts of a country.

So the taxes that companies pay can look very different to the headline rates of tax charged.

2 years ago

37

2 years ago

37

English (US) ·

English (US) ·